- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

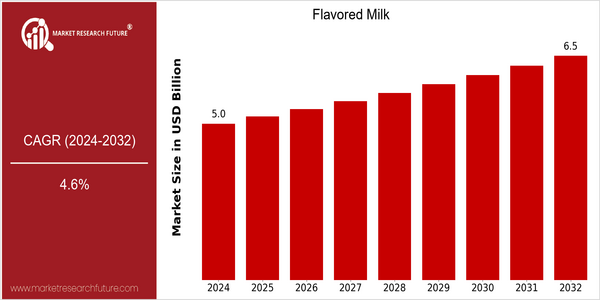

| Year | Value |

|---|---|

| 2024 | USD 5.0 Billion |

| 2032 | USD 6.5 Billion |

| CAGR (2024-2032) | 4.6 % |

Note – Market size depicts the revenue generated over the financial year

The flavoured milk market is projected to grow at a CAGR of 4.6% from 2024 to 2032, and the market is expected to reach $ 6.5 billion by 2032, at a CAGR of 4.6%. The trend of growth is mainly driven by the change in consumer preferences for healthier and more diverse beverages. Especially among the younger generation, the taste for flavored milk is becoming more and more popular, and the demand for the market is growing rapidly. Also, with the increase in public awareness of the nutritional value of flavored milk, such as the content of vitamin B12 and B12, the proportion of consumption of flavored milk is expected to increase. The trend of growth is also favored by the development of the formulation, such as the development of lactose-free and plant-based flavored milk. The major players in the industry, such as Nestlé, Danone and Coca-Cola, are focusing on the development of strategic alliances and the launch of new products to strengthen their market positions. The introduction of new flavors and the use of sustainable packaging materials is an example of how companies are responding to the trend of the times.

Regional Market Size

Regional Deep Dive

Flavored milk market is growing at a fast pace in different regions of the world, owing to changing consumer preferences, health awareness and new product launches. North America is characterized by strong demand for organic and low-sugar products, while Europe is witnessing a rise in the consumption of premium flavored milk. The Asia-Pacific region is characterized by rapid urbanization and growing youth population. The Middle East and Africa are characterized by strong demand for dairy products. Latin America is also emerging as a significant market, with a focus on local flavors and nutritional benefits. The flavored milk market is a strong growth market, shaped by regional preferences and health trends.

Europe

- The European market is seeing a trend towards premium flavored milk products, with brands like Arla Foods and FrieslandCampina launching high-quality, gourmet options that cater to discerning consumers.

- Sustainability initiatives are gaining traction, with companies investing in eco-friendly packaging and sourcing practices, influenced by EU regulations aimed at reducing plastic waste.

Asia Pacific

- The rapid urbanization and increasing disposable income in countries like China and India are driving the demand for flavored milk, with local brands such as Nestlé and Amul introducing region-specific flavors to capture market share.

- Innovations in packaging, such as single-serve and on-the-go options, are becoming popular among younger consumers, reflecting a shift towards convenience in the beverage sector.

Latin America

- Local flavors and nutritional benefits are driving the flavored milk market in Latin America, with brands like Laive and Parmalat focusing on traditional tastes to appeal to regional consumers.

- The rise of e-commerce platforms is facilitating greater access to flavored milk products, allowing brands to reach a wider audience and adapt to changing shopping behaviors.

North America

- The rise of health-conscious consumers has led to an increase in demand for organic and low-sugar flavored milk options, with companies like Horizon Organic and Organic Valley leading the charge in product innovation.

- Recent regulatory changes in labeling requirements by the FDA have prompted manufacturers to reformulate their products to meet new health standards, which is expected to enhance consumer trust and drive sales.

Middle East And Africa

- Cultural preferences for dairy products are strong in the Middle East, with flavored milk being integrated into traditional diets, leading to increased product offerings from local companies like Almarai.

- Government initiatives promoting dairy consumption for nutritional benefits are encouraging the growth of flavored milk products, particularly in schools and community programs.

Did You Know?

“In the United States, flavored milk accounts for nearly 30% of all milk consumed by children, highlighting its popularity as a nutritious beverage option.” — International Dairy Foods Association

Segmental Market Size

Flavored milk plays a key role in the dairy industry, which is currently growing steadily due to changing consumer preferences for taste and nutrition. The increasing health consciousness of consumers and the growing popularity of flavored milk among children and young adults are driving this demand. In addition, the development of new products and marketing strategies by companies such as Nestlé and Danone are also contributing to the positive development of the market. At present, the flavored milk industry is in a mature stage of development, and in North America, companies such as Horizon Organic and Fairlife are the leaders. The main products are mainly flavored milk drinks, which are often positioned as nutritious snacks or meal replacements. The trend towards plant-based alternatives and the development of green products have also accelerated the growth of flavored milk. However, the key to the development of this industry is the development of new processing methods and flavoring techniques, which can ensure the competitiveness and popularity of flavored milk.

Future Outlook

The flavoured milk market is expected to grow steadily from 2024 to 2032, with an estimated value of US$5 billion to $US6 billion, representing a CAGR of 4.6%. The demand for convenient, nutritious and tasty drinks is especially strong among young people. In addition, health-conscious consumers are increasingly turning to flavoured milk as an alternative to sugary drinks. Flavoured milk is expected to become the new favourite beverage of the on-the-go population in cities. The development of new formulations and packaging will further boost the flavoured milk market. Meanwhile, the growing popularity of plant-based diets is expected to lead to a rise in flavoured milk alternatives for lactose-intolerant consumers and for those who want to avoid dairy products. The development of dairy farming in developing countries will also contribute to the growth of the flavoured milk market. The market is expected to continue to evolve as brands continue to diversify and evolve, and consumers continue to opt for healthier and more sustainable beverages.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 4.6% (2023-2030) |

Flavored Milk Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.