Focus on Mental Health

The Fitness Equipment Home & Gym Training Market is increasingly recognizing the connection between physical fitness and mental well-being. As awareness of mental health issues rises, more individuals are turning to exercise as a means of stress relief and emotional stability. This trend has led to a growing demand for fitness equipment that supports holistic wellness, including yoga mats, meditation tools, and strength training gear. Market data indicates that the wellness segment of the fitness industry is expanding, with consumers seeking products that promote both physical and mental health. Consequently, manufacturers are responding by creating equipment that aligns with this dual focus, thereby enhancing their market appeal.

Increased Health Awareness

The Fitness Equipment Home & Gym Training Market is experiencing a surge in demand driven by heightened health awareness among consumers. Individuals are increasingly prioritizing their physical well-being, leading to a rise in home fitness solutions. According to recent data, approximately 70% of adults engage in regular physical activity, which has prompted a corresponding increase in the purchase of fitness equipment. This trend suggests that consumers are investing in home gym setups to maintain their fitness routines conveniently. As a result, manufacturers are responding by offering a diverse range of products tailored to various fitness levels and preferences, thereby expanding the market's reach.

Technological Advancements

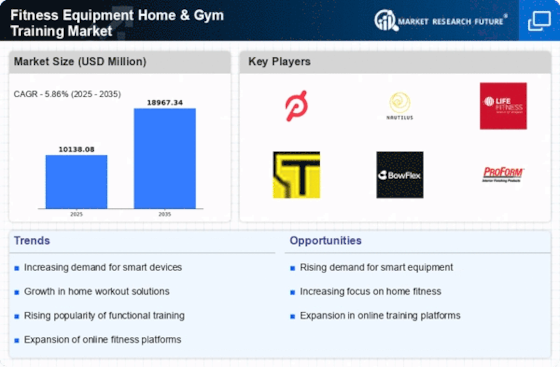

Technological innovations are reshaping the Fitness Equipment Home & Gym Training Market, as smart fitness devices gain traction. The integration of technology into fitness equipment, such as wearables and connected machines, enhances user experience and engagement. For instance, the market for smart fitness equipment is projected to grow significantly, with estimates indicating a compound annual growth rate of over 20% in the coming years. This growth is attributed to features like real-time performance tracking, personalized workout plans, and interactive training sessions. Consequently, consumers are increasingly drawn to these advanced solutions, which not only improve workout efficiency but also foster a sense of community among users.

Shift Towards Home Workouts

The Fitness Equipment Home & Gym Training Market is witnessing a notable shift towards home workouts, as more individuals opt for convenience and flexibility in their fitness routines. This trend is reflected in the increasing sales of home gym equipment, which have reportedly risen by over 30% in recent years. Consumers are seeking ways to integrate fitness into their daily lives without the constraints of traditional gym memberships. This shift is further supported by the proliferation of online fitness classes and virtual training programs, which provide accessible options for users. As a result, the market is adapting to meet the growing demand for versatile and space-efficient fitness solutions.

Diverse Consumer Demographics

The Fitness Equipment Home & Gym Training Market is characterized by a diverse consumer base, encompassing various age groups and fitness levels. This demographic diversity is driving manufacturers to develop a wide array of products that cater to specific needs, from beginner-friendly equipment to advanced training tools for seasoned athletes. Recent studies indicate that millennials and Gen Z are particularly inclined towards home fitness solutions, with a significant percentage expressing interest in investing in personal training equipment. This trend suggests that the market must continually innovate to appeal to these younger consumers, who prioritize functionality, aesthetics, and technology in their fitness choices.

Leave a Comment