Rising Incidence of Wildfires

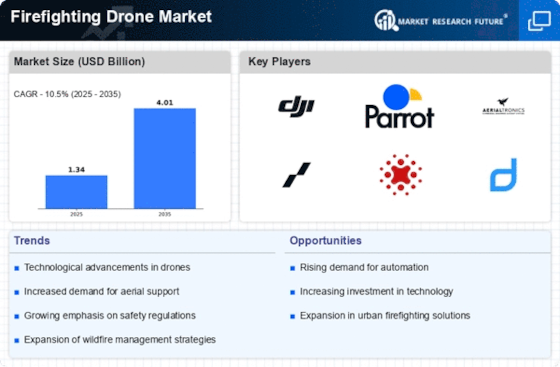

The Firefighting Drone Market is significantly influenced by the rising incidence of wildfires, which has become a pressing concern in many regions. The increasing frequency and intensity of wildfires necessitate more effective firefighting strategies, prompting agencies to explore innovative solutions such as drones. Drones can cover vast areas quickly, providing real-time surveillance and delivering water or fire retardants to inaccessible locations. Recent data indicates that the number of wildfires has surged by over 30% in the last decade, underscoring the urgent need for advanced firefighting technologies. This trend is likely to drive demand for firefighting drones, as they offer a rapid response capability that traditional methods may lack. Consequently, the market is poised for substantial growth as firefighting agencies seek to enhance their operational readiness.

Growing Awareness of Environmental Impact

The Firefighting Drone Market is increasingly shaped by growing awareness of the environmental impact of traditional firefighting methods. Conventional techniques often involve the use of chemicals and large amounts of water, which can have detrimental effects on ecosystems. Drones, on the other hand, offer a more environmentally friendly alternative by enabling targeted application of fire retardants and minimizing collateral damage. This shift in perspective is prompting firefighting agencies to adopt drone technology as part of their sustainability initiatives. As environmental concerns continue to gain prominence, the market for firefighting drones is likely to experience accelerated growth, with projections indicating a potential increase of 18% in market size over the next few years.

Regulatory Support for Firefighting Drones

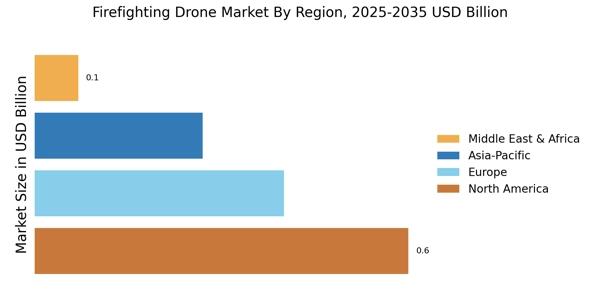

The Firefighting Drone Market benefits from increasing regulatory support aimed at integrating drones into emergency response frameworks. Governments are recognizing the potential of drones to enhance firefighting capabilities, leading to the establishment of guidelines and standards for their use. This regulatory environment encourages investment and innovation within the sector. For instance, certain regions have implemented policies that facilitate the deployment of drones in urban firefighting scenarios, thereby expanding their operational scope. As regulations evolve, they are likely to create a more structured market, fostering collaboration between drone manufacturers and firefighting agencies. This supportive framework is expected to contribute to a market growth rate of around 20% in the coming years, as more agencies adopt drone technology.

Increased Investment in Firefighting Technologies

The Firefighting Drone Market is witnessing increased investment in firefighting technologies, reflecting a broader trend towards modernization in emergency response. Public and private sectors are allocating significant resources to develop and deploy advanced firefighting solutions, including drones. This influx of capital is facilitating research and development efforts aimed at improving drone capabilities, such as payload capacity and flight endurance. Furthermore, partnerships between technology firms and firefighting agencies are becoming more common, leading to innovative applications of drone technology in firefighting. As investment continues to rise, the market is expected to expand at a rate of approximately 22% annually, driven by the need for more efficient and effective firefighting methods.

Technological Advancements in Firefighting Drones

The Firefighting Drone Market is experiencing rapid technological advancements that enhance operational efficiency and effectiveness. Innovations such as thermal imaging, real-time data transmission, and autonomous navigation systems are becoming increasingly prevalent. These technologies allow drones to detect hotspots and assess fire spread more accurately, which is crucial for timely intervention. The integration of artificial intelligence and machine learning algorithms further optimizes flight paths and resource allocation. As a result, the market is projected to grow at a compound annual growth rate of approximately 25% over the next five years, driven by the demand for more sophisticated firefighting solutions. This trend indicates a shift towards more automated and intelligent firefighting systems, which could redefine traditional firefighting strategies.