Fire Rated Ducts Size

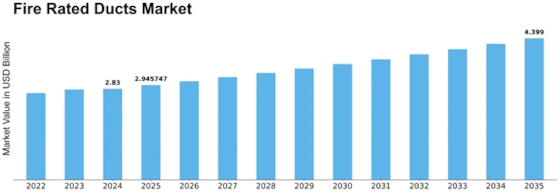

Fire Rated Ducts Market Growth Projections and Opportunities

The demand for fire-rated ducts is going up all around the world because people are realizing the importance of having good fire safety solutions. This is also happening because governments are making strict rules about fire safety. These rules are making companies use fire-rated ducts to protect buildings from fires.

The global market for fire-rated ducts is expected to grow by about 4.18% every year from 2020 to 2026. In 2019, Asia had the biggest share of the market with 43.1%, followed by North America with 31.1%, and Europe with 25.8%.

The market for fire-rated ducts is divided into different categories based on things like shape, use, service, material, and where they are used. In terms of shape, fire-rated ducts can be round, half-round, rectangular, triangular, or other shapes. The rectangular ones are expected to grow the fastest, and in 2019, they made up 35.1% of the market.

When it comes to how they are used, fire-rated ducts can be used in public facilities, commercial buildings, industrial spaces, and other places. The use in commercial buildings is expected to grow the fastest. In 2019, industrial spaces had the biggest share with 36.9%.

Different services are needed for fire-rated ducts, like core drilling, seals, and duct installation. Duct installation is expected to grow the fastest. In 2019, it made up 36.9% of the market.

Fire-rated ducts can be made of different materials like steel, aluminum, fiberglass, polymers, and others. The ones made of steel are expected to grow the fastest. In 2019, steel ones made up 34.9% of the market.

Depending on where they go in a building, fire-rated ducts can be put in walls, decks, floors, and other places. The ones put in decks are expected to grow the fastest. In 2019, they made up 42.9% of the market.

In conclusion, the demand for fire-rated ducts is increasing all over the world because of the growing awareness of the need for fire safety. The market is expected to grow, especially in categories like rectangular ducts, commercial use, duct installation, steel materials, and decks placement. This growth is influenced by strict government regulations emphasizing the importance of fire safety in various settings.

Leave a Comment