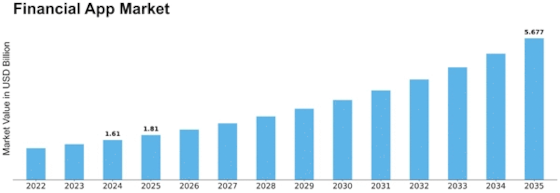

Financial App Size

Financial App Market Growth Projections and Opportunities

The financial app market is a dynamic ecosystem motivated by diverse market elements that shape its growth and evolution. One of the number one drivers is technological advancement. As the generation keeps progressing, financial apps leverage innovations, which include synthetic intelligence, blockchain, and information analytics, to offer more state-of-the-art and efficient answers. This now not only complements user enjoyment but additionally expands the capability and capabilities of financial apps, making them more appealing to customers. Regulatory elements additionally exert a significant impact on the financial app market. Governments and regulatory bodies worldwide are continuously updating and implementing regulations to ensure the safety and privacy of monetary transactions. Compliance with these regulations is important for financial app developers to take advantage and hold the trust of customers. As regulations evolve, builders ought to adapt their apps to satisfy new requirements that may affect the functions, safety features, and usual design of financial apps. Global economic conditions are another key component influencing the financial app marketplace. Economic stability, inflation charges, and interest costs can affect client spending styles, funding behaviors, and ordinary economic activities. Economic downturns can also result in multiplied demand for budgeting and financial management apps, at the same time as periods of increase can also see a surge in investment and trading apps. Financial app developers want to live attuned to these financial fluctuations to tailor their services to the evolving wishes of customers. Competition inside the financial app market is extreme, with new entrants constantly emerging. Established financial establishments, fintech startups, and generation giants all vie for a proportion of the market. This opposition drives innovation as builders strive to differentiate their apps through unique functions, consumer interfaces, and fee propositions. User evaluations, rankings, and phrase-of-mouth play a critical position in establishing an app's reputation, influencing consumer alternatives in an exceptionally aggressive landscape. Security issues additionally appreciably impact the financial app marketplace. As customers entrust those apps with touchy economic records, protection breaches can have extreme effects, eroding trust and causing reputational damage. Developers have to put money into strong security measures, along with encryption protocols, multi-element authentication, and normal safety updates, to protect user records and preserve the integrity of their apps.

Leave a Comment