Ferric Oxide Size

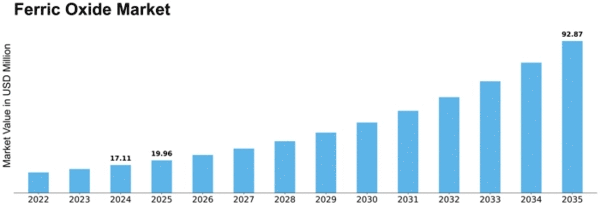

Ferric Oxide Market Growth Projections and Opportunities

In the Ferric Oxide market there are internal and external factors such as market share, competition, government regulations which have an influence on the market dynamics. A major driver of this demand is the expanding use of rust, or ferric oxide, in various industries like adhesives, coatings, die cuttings and binders. Wide scope of the pigments usage within the paintworks, coatings and decorative pigments production has been the source of the market expansion. Simultaneously we see the growth of construction sector around the globe and this has prompt a rise in the demand of ferric oxide in making the paints that are durable and therefore weather resistant which consequently increases the size of market.

In addition, the automotive industry’s usage of ferric oxide as a coloring material for different components constitute a further boom in the market’s growth. Along with the growing number of vehicles on roads, there is a profuse demand for ferric oxide that finds use in these coatings and pigments. Growth in this sector is largely a factor that will be bolstered by the sector still broadening, especially in developing markets.

Lately, along with primary from downstream industry, regulator aspects take up another important role in forming the Ferrous Oxide market. Eco-friendly pigments produced of ferric oxide have taken over the market of paints and coatings, which is due to the enactment of the stricter environmental regulations commonly directed to chemical fibres. The environment friendly feature of this alternative coupled with its small scale/local impact which cause it to be the number one pick of industries that strive to meet the most demanding set of rules and guidelines. Whenever the local and central governments of various countries all over the world in effect implement sustainable, eco-friendly methods of doing business, the market for ferric oxide is expected to thrive.

Yet, a second component of the markets are the global economic conditions too. Stability of economic shifts of certain regions affects the whole demand of ferric oxide. During times of booming economics, the construction and manufacturing plants are likely to experience the increase of their activities and, in consequence, the demand for iron oxide rises as well. Contrariwise, when the economy suffer recession tend to come with a slowdown of business activity, which may in turn affect the market negatively.

Both the emerging technology and the integration of novel production methods in the production of the ferric oxide create market dynamics. Production efficiency, cost effectiveness and quality, which are always trying to be enhanced by manufacturers, have an integral part in the development of this market. Trend setting nanotechnology innovations, for example, have found niche fields for utilization of Ferric oxide in different industries that as a result have increased the market potential

Market factors are not merely tied to supply and demand, but they also affect prices and make the market more transparent. Geopolitical factors, including some others, can also have an impact on ferric oxide marlet situation. The trade conflicts, political uncertainty, and incessant currency fluctuations impart shocks to the balance of global supply chain which further cause ferric oxide shortage and hike. Uncertainty strikes industry players scrambling through the complex way trying to maintain the same normalcy in their operations.

Leave a Comment