Top Industry Leaders in the Fatty Alcohol Ethoxylates Market

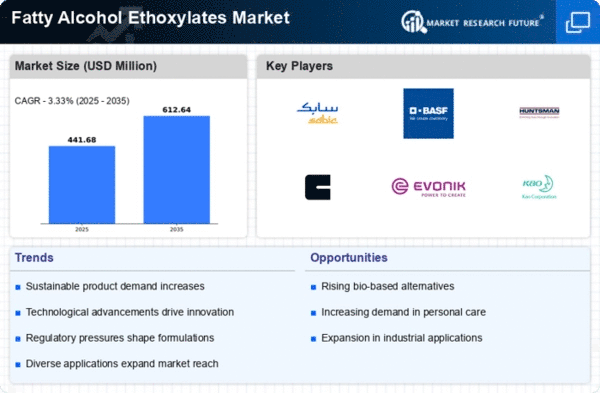

The Fatty Alcohol Ethoxylates (FAE) market, a critical segment of the surfactant industry, churns with competition, witnessing a steady climb. These versatile non-ionic surfactants find their way into myriad applications, from household cleaners and cosmetics to textiles and agrochemicals. But beneath the sudsy surface lies a complex competitive landscape, where industry giants and niche players alike battle for market share.

The Fatty Alcohol Ethoxylates (FAE) market, a critical segment of the surfactant industry, churns with competition, witnessing a steady climb. These versatile non-ionic surfactants find their way into myriad applications, from household cleaners and cosmetics to textiles and agrochemicals. But beneath the sudsy surface lies a complex competitive landscape, where industry giants and niche players alike battle for market share.

Strategies Shaping the Flow:

-

Innovation & Diversification: Leading players like BASF, Stepan Chemical, and Huntsman Corporation are pushing the boundaries with novel FAE formulations boasting enhanced biodegradability, low foaming properties, and tailor-made functionalities for specific end-use sectors. Diversification into niche applications like personal care and agrochemicals is also key. -

Vertical Integration: Securing a steady supply of key raw materials like fatty alcohols and ethylene oxide is crucial. Companies like Wilmar and Croda International are investing in backward integration to gain control over supply chains and mitigate price fluctuations. -

Sustainability Focus: Consumer and regulatory pressures are pushing the FAE market towards eco-friendlier options. Players are adopting greener production processes, using renewable feedstocks, and developing readily biodegradable FAEs to comply with stringent environmental regulations. -

Geographic Expansion: Emerging economies in Asia and Africa present massive growth potential. Companies like Kao Corporation and Clariant are establishing production facilities and forging strategic partnerships in these regions to capitalize on the rising demand.

Navigating the Currents: Factors Influencing Market Share:

-

Price Volatility: Crude oil, a key precursor for fatty alcohols, is susceptible to price swings, impacting FAE production costs and profitability. Players with robust hedging strategies and diversified product portfolios can weather such turbulence. -

Regulatory Landscape: Stringent regulations on ingredients and environmental impact, like the REACH regulations in Europe, are shaping the FAE market. Companies with compliant and biodegradable FAE formulations gain a competitive edge. -

Supply Chain Disruptions: Geopolitical tensions and trade wars can disrupt the flow of raw materials and finished products. Flexible sourcing networks and agile production capabilities are crucial to mitigate such disruptions. -

Innovation & Differentiation: Developing advanced FAEs with superior performance characteristics and catering to specific industry needs like high-foaming or low-foaming properties holds the key to differentiation and market leadership.

Key Players:

Key players of the Global Fatty Alcohol Ethoxylates Market are

- P&G Chemicals (US)

- Clariant (Europe)

- BASF SE (Germany)

- Akzo Nobel N.V. (Netherlands)

- Huntsman International LLC. (US)

- Ecogreen Oleochemicals (Germany)

- Unitop Chemicals Pvt. Ltd. (India)

- Rimpro-India (India)

- Shree Vallabh Chemicals (India)

- GUJARAT CHEMICALS (India)

Recent Developments

-

September 2023: Clariant unveils a new line of readily biodegradable FAEs specifically designed for the personal care industry, tapping into the growing demand for sustainable cosmetics. -

October 2023: BASF and Stepan Chemical announce a joint research project to develop bio-based feedstocks for FAE production, aiming to reduce reliance on fossil fuels. -

November 2023: Wilmar expands its FAE production capacity in Indonesia, catering to the increasing demand from the rapidly growing Southeast Asian market. -

December 2023: The FAE market exhibits signs of stabilization following a period of price volatility, with cautious optimism for steady growth in 2024