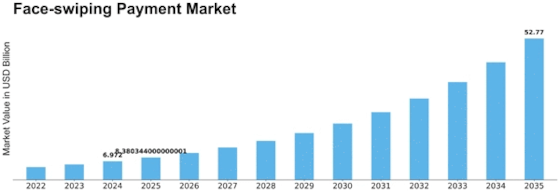

Face Swiping Payment Size

Face-swiping Payment Market Growth Projections and Opportunities

Face Swiping Payment has become a groundbreaking trend in digital transactions, redefining how we pay for things and interact with financial services. Market forces of face swiping payments are connected to the rise of biometric authentication, ease of transaction as well as the increase in the usage of contactless payment methods.

Face swiping payment essentially involves using facial recognition technology to authenticate and authorize financial transactions. This novel approach does not require physical cards or cash thereby giving users a smooth secure payment experience. The market dynamics of face swiping payments are mostly motivated by the need for increased security in financial transactions because unlike traditional methods, facial recognition offers an additional layer of authentication.

One of the primary reasons why the Face Swiping Payment market is growing is due to the increasing role that biometrics play in identity verification. With more cyber threats and incidents involving thefts of identities happening than ever before, there is an urgent need for robust ways through which people can be authenticated. For example, face swiping payments rely on facial recognition as a distinct biometric identifier thus providing an easy and safe way to authenticate user’s identity before processing a payment. This aspect significantly influences the market dynamics about face swiping payments.

Moreover, they are driven by consumers’ demand for frictionless and convenient payment experiences. Face swiping payments also fall in line with broader trends in contactless transactions where one does not have to reach out physically to card or input PIN codes while making a purchase. The ease with which one can use his/her own face to accomplish a transaction makes it more efficient and user-friendly when compared to other approaches employed by some businesses/retailers today where clients punch numbers on their pads or press thumbprint scanners. It is anticipated that as customers continue searching for simpler ways through which they can make their payments without any disturbances from sellers, this market will keep expanding.

On top of this, market dynamics are also influenced by the adoption of smartphones with built-in facial recognition. As smartphones become a vital part of people’s everyday life, it is only logical to extend their use to payment operations through facial identification. Hence, this has further sped up the acceptance and implementation of face swiping payments where individuals can conveniently use their own devices they carry on them for safe financial transactions.

The COVID-19 pandemic has highly contributed to the market dynamics for face swiping payments. The increased awareness in matters of hygiene together with minimizing physical contact gave rise to a higher demand for contactless payment methods. Thus, face swiping emerged as an inherently contactless type that is safer than traditional payment systems thereby forcing its market size to expand quickly.

In terms of competition within the market, different technology companies, financial institutions and start-ups have been contributing significantly towards driving growth in Face-Swiping-Payment. These include among others refining algorithms for facial recognition, ensuring privacy regulations compliance and improving overall user experience.

Leave a Comment