Top Industry Leaders in the Explosives Pyrotechnics Market

Explosives and pyrotechnics Market

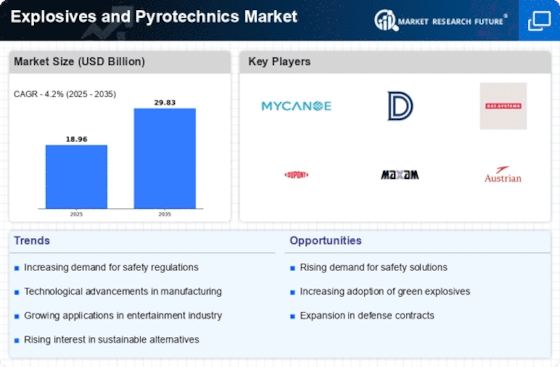

The Explosives and Pyrotechnics market is a dynamic and crucial sector, playing a pivotal role in various industries such as mining, defense, entertainment, and construction. The competitive landscape of this market is marked by innovation, stringent regulations, and a constant pursuit of efficiency and safety. In this analysis, we delve into the key players, their strategies, market share analysis factors, emerging companies, industry news, and investment trends that define the current competitive scenario.

Key Players and Market Dynamics: Hanwha Corp.

Solar Industries India

LSB Industries

Zambelli Fireworks

Melrose Pyrotechnics

Angelfire Pyrotechnics

Skyburst

Howard & Sons

Entertainment Fire-works

Supreme Fireworks UK

Celebration Fireworks

Impact Pyro

Societe Nationale Des Poudres Et Explosifs (SNPE)

Strategies Adopted by Key Players: Key players in the Explosives and Pyrotechnics market adopt diverse strategies to maintain and enhance their market positions. Innovation in product development is a common theme, with an emphasis on creating safer and more efficient explosives. Additionally, strategic partnerships and collaborations are prevalent, allowing companies to tap into complementary expertise and gain access to new markets. Market leaders often invest significantly in research and development to introduce cutting-edge technologies that meet evolving industry standards and regulations.

Factors for Market Share Analysis: Several factors contribute to the analysis of market share in the Explosives and Pyrotechnics sector. Technology leadership, global presence, regulatory compliance, and customer trust are key determinants. Companies that invest in sustainable and eco-friendly solutions are gaining a competitive edge, given the increasing emphasis on environmental concerns. Moreover, an ability to adapt quickly to market changes, geopolitical factors, and economic fluctuations play a crucial role in establishing and maintaining market share.

New and Emerging Companies: While established players dominate, the Explosives and Pyrotechnics market also witnesses the emergence of new and innovative companies. These entrants often bring fresh perspectives and technologies, challenging traditional norms. Companies such as Solaris Technologies and Dynasafe International are making strides with their focus on environmentally friendly solutions and advanced disposal technologies. The entry of these players intensifies competition, fostering an environment of continuous innovation and improvement.

Industry News and Innovations: The Explosives and Pyrotechnics market is ever-evolving, with industry news and innovations shaping its trajectory. Ongoing research in materials science and chemistry is leading to the development of safer and more stable explosives. The integration of digital technologies, such as artificial intelligence and automation, is streamlining manufacturing processes and enhancing safety measures. The market is also witnessing advancements in precision blasting techniques, reducing environmental impact and optimizing resource utilization.

Current Company Investment Trends: Investment trends in the Explosives and Pyrotechnics sector reflect a commitment to sustainability, safety, and technological advancement. Companies are allocating significant resources to research and development, aiming to create groundbreaking solutions with reduced environmental impact. Additionally, investments in expanding production capacities and strengthening distribution networks are prevalent, ensuring a seamless supply chain to meet growing global demand. Sustainable practices, from responsible sourcing of raw materials to eco-friendly disposal methods, are becoming integral components of companies' investment strategies.

Overall Competitive Scenario: The overall competitive scenario in the Explosives and Pyrotechnics market is characterized by a delicate balance between established players, new entrants, and disruptive innovations. Market leaders are focused on consolidating their positions through strategic alliances and continuous improvement in product offerings. Regulatory compliance and sustainability are emerging as decisive factors, influencing both consumer preferences and government procurement policies.

The Explosives and Pyrotechnics market is witnessing a paradigm shift driven by technological advancements, sustainability concerns, and dynamic geopolitical landscapes. Key players are adapting to these changes through strategic initiatives, collaborations, and investments in innovation. The emergence of new companies and the infusion of cutting-edge technologies are reshaping the competitive landscape, creating a vibrant and competitive environment that promises further evolution in the coming years.

Recent News :

Recent Key Company News in the Explosives and Pyrotechnics Market (January 30, 2024):

Mergers & Acquisitions:

Orica Mining Services (ASX:ORI), a leading global explosives and blasting services provider, announced plans to acquire Detonex Inc., a US-based manufacturer of detonators and related blasting accessories, for $425 million. This deal is expected to strengthen Orica's position in the North American market and expand its product offerings.

Pyrodex Corporation (OTCQX:PRDY), a US-based manufacturer of black powder and pyrotechnic components, agreed to be acquired by Nammo Group, a Norwegian defense and aerospace company, for an undisclosed amount. This acquisition will provide Nammo with access to Pyrodex's expertise in pyrotechnics, potentially benefiting its military and commercial applications.

Investments & Partnerships:

Hanwha Corporation (KRX:00954), a South Korean conglomerate with a significant explosives business, announced a joint venture with U.S. Venture Partners to invest in emerging technologies for the explosives and pyrotechnics industry. The partnership aims to develop safer, more efficient, and environmentally friendly explosives and pyrotechnic products.

MAXAM Corp. (BME:MAX), a Spanish explosives and mining services company, signed a strategic partnership with IBM (NYSE:IBM) to implement AI and cloud-based solutions for optimizing its blasting operations and improving safety. This partnership could lead to significant efficiency gains and cost reductions for MAXAM.

New Products & Technologies:

Austin Powder Company, a US-based explosives manufacturer, launched its new "EcoPrime" line of environmentally friendly blasting emulsions. These emulsions are formulated with recycled materials and contain fewer hazardous chemicals, making them a more sustainable alternative to traditional blasting products.

Chemring Group (LSE:CHM), a UK-based defense and aerospace company, unveiled its new "DragonFire" range of pyrotechnic displays for military and civilian applications. DragonFire displays are designed to be more customizable, reliable, and environmentally friendly than traditional pyrotechnics.

Regulatory Developments:

The United States Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) proposed new regulations on the sale and use of consumer fireworks. The proposed regulations aim to reduce firework-related injuries and fires, but have been met with opposition from the fireworks industry.

The European Union (EU) is considering stricter regulations on the use of pyrotechnics in events and festivals. The EU is concerned about the safety risks and environmental impact of pyrotechnics, and is seeking to balance these concerns with the cultural and economic importance of fireworks displays.