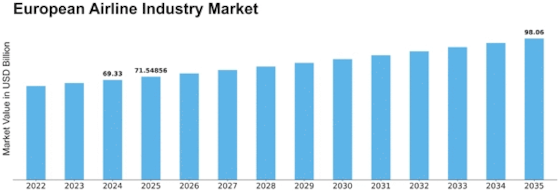

European Airline Industry Size

European Airline Industry Market Growth Projections and Opportunities

Helicopters, characterized by overhead rotors facilitating lift, represent a distinct category of aircraft. The helicopter market is poised for significant growth in the foreseeable future, primarily fueled by the increasing demand for helicopters in the realm of medical services. Forecasts indicate a noteworthy Compound Annual Growth Rate (CAGR) of 3.2% for the helicopter market during the forecast period spanning from 2022 to 2030. One of the driving forces behind the anticipated growth is the expanding utilization of helicopters in medical services. Helicopters play a crucial role in facilitating rapid and efficient medical transport, particularly in emergency situations. The ability of helicopters to navigate challenging terrains and swiftly reach remote locations makes them invaluable in critical healthcare scenarios. As the healthcare sector continues to recognize and leverage the advantages of helicopter-based medical services, the overall demand for helicopters is expected to witness an upward trajectory. Projections for the period from 2022 to 2030 underscore the resilience and potential of the helicopter market, with the expected CAGR highlighting sustained growth prospects. The coming decade is anticipated to witness a surge in demand for helicopters across various sectors, driven by evolving needs and advancements in helicopter technology. Analyzing the market dynamics in 2021 reveals North America as the dominant player, commanding a substantial market share of 32.6%. The region's leadership position can be attributed to its well-established aviation infrastructure, a robust history of helicopter applications across diverse sectors, and a particularly strong presence in medical emergency services utilizing helicopters. Following North America, Europe emerges as another significant contributor, holding a considerable market share of 29.2%. The European market's prominence is fueled by diverse applications of helicopters, ranging from medical services to search and rescue operations. Additionally, advancements in helicopter technology and manufacturing practices contribute to the robust demand in the European market. In the Asia-Pacific region, the helicopter market exhibits a noteworthy share of 22.8%, emphasizing the region's increasing role in shaping the global helicopter market. The diverse applications of helicopters in emergent economies for medical evacuation services and the burgeoning tourism sector contribute to the region's market presence. In conclusion, the helicopter market is at the brink of substantial growth, driven by the pivotal role of helicopters in medical services and their versatility across various industries. The regional dominance of North America, Europe, and Asia-Pacific signifies a global landscape with unique contributions from each region. With the expected CAGR pointing towards sustained expansion, the helicopter market is set to play a pivotal role in meeting the dynamic demands of diverse sectors in the years to come.

Leave a Comment