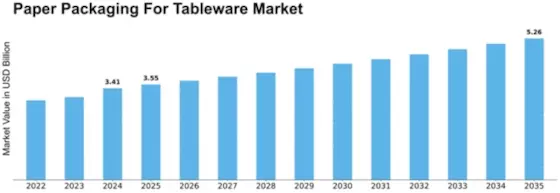

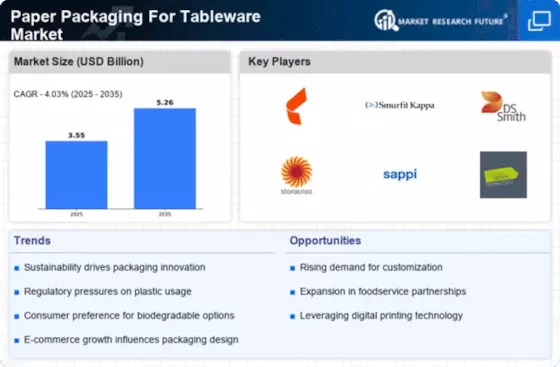

Europe Paper Packaging For Tableware Size

Europe Paper Packaging for Tableware Market Growth Projections and Opportunities

The Europe paper packaging for tableware market is influenced by various factors that shape its dynamics and drive its growth. One significant factor is the increasing consumer preference for eco-friendly and sustainable packaging solutions. With growing environmental awareness and concerns about plastic pollution, there has been a shift towards paper-based packaging for tableware items such as plates, cups, and trays. Paper packaging offers advantages such as recyclability, biodegradability, and renewable sourcing, making it an attractive option for environmentally conscious consumers and businesses. This trend drives the demand for paper packaging for tableware in Europe, fueling market expansion.

Moreover, regulatory initiatives and policies aimed at reducing single-use plastics further drive the adoption of paper packaging for tableware in Europe. The European Union has implemented regulations and directives to curb plastic waste and promote the use of sustainable alternatives. For instance, the EU Single-Use Plastics Directive restricts the use of certain plastic products, including disposable tableware items, encouraging the adoption of paper-based alternatives. Compliance with these regulations and alignment with sustainability goals are essential drivers of growth in the Europe paper packaging for tableware market.

Another factor influencing the market is the growing foodservice industry in Europe. The region has a thriving food and beverage sector, including restaurants, cafes, catering services, and events. With increasing consumer demand for convenience and on-the-go meals, there is a corresponding demand for disposable tableware items. Paper packaging offers a convenient and hygienic solution for foodservice establishments, providing a lightweight, disposable, and cost-effective option for serving food and beverages. The expanding foodservice sector drives the demand for paper packaging for tableware, contributing to market growth.

Technological advancements in paper manufacturing and packaging processes also play a significant role in market development. Manufacturers are continually investing in research and development to improve the quality, performance, and sustainability of paper packaging materials and production techniques. Innovations in paper processing, coating technologies, and printing methods enhance the strength, moisture resistance, and visual appeal of paper-based tableware packaging. Additionally, advancements in machinery and automation optimize production efficiency, reduce waste, and lower production costs, meeting the growing demand for high-quality paper packaging solutions in Europe.

Market competition is another factor shaping the Europe paper packaging for tableware market landscape. Key players in the industry engage in competitive strategies such as product differentiation, pricing tactics, and strategic partnerships to gain a competitive edge and expand their market share. Established paper packaging manufacturers leverage their brand reputation, distribution networks, and technical expertise to maintain leadership positions. On the other hand, emerging players focus on innovation, niche markets, and customized solutions to establish their presence and compete effectively in the market.

Moreover, economic factors such as consumer spending, disposable income, and market dynamics influence the demand for paper packaging for tableware in Europe. Economic downturns may lead to reduced consumer spending on discretionary items, affecting the demand for disposable tableware products. Conversely, economic recovery, increased consumer confidence, and growth in the foodservice sector stimulate demand for paper packaging for tableware, driving market expansion.

Consumer preferences and industry trends also impact the Europe paper packaging for tableware market. There is a growing demand for customizable, aesthetically pleasing, and branded paper packaging solutions that reflect the image and values of foodservice establishments. Additionally, trends such as food delivery services, takeaway meals, and outdoor dining experiences drive the demand for portable, leak-proof, and microwaveable paper packaging options for tableware items. Manufacturers respond to these trends by offering innovative packaging designs, functional features, and sustainable materials, meeting the evolving needs of customers in the European market.

Leave a Comment