Europe Metal Plating And Finishing Size

Europe Metal Plating and Finishing Market Growth Projections and Opportunities

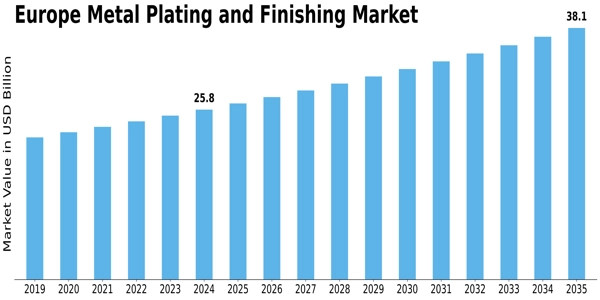

There are several elements that, taken together, shape the European metal Plating and Finishing Market's dynamics and growth direction. One of the main drivers of this market is a strong manufacturing base in the region, including automotive, electronics, aerospace, etc., relying heavily on Metal Plating and Finishing practices. The European Market for Metal Plating and Finishing reached USD 0.5 bn by value in 2022. The Metal Plating and Finishing Industry is expected to reach USD 0.789 billion by 2032, up from USD 0.54 Billion in 2023 at a CARG of 4.80% during the forecast period (2023 – 2032). Europe's Metal Plating and Finishing Market is impacted by changing environmental regulations. The European Union (EU) has stringent environmental standards, and the metal finishing industry is regulated to reduce the environmental impact of plating procedures. Advancements in the technology of the Metal Plating and Finishing processes play a critical role in shaping the market landscape. Research and development endeavors result in new-generation plating techniques, such as electroless nickel plating, that provide improved corrosion resistance, uniform coating thickness, and reduced environmental footprint. Automotive and electronics industries' emphasis on lightweight materials and miniaturization also affects market factors. These industries strive for better fuel economy, low-emission products, and miniature electronic apparatuses; hence, Metal, Plating, and Finishing processes become important aspects for lightweight structures, corrosion protection, and better conduction. Europe's Metal plating & finishing market is influenced by the economic environment as well as industrial trends. Growth in the economy and industrial expansion, among other investment activities aimed at developing manufacturing infrastructure, have an impact on the demand for metal plating services. Market dynamics are directly influenced by the health conditions of end use sectors such as automotive and electronics since these sectors are major consumers of Metal Plating and Finishing services in Europe. The competitive landscape and industry collaborations also contribute to market dynamics. European metal plating entities engage in partnerships with manufacturers, research institutions, and policy-making bodies to remain at the forefront of technological developments and ensure compliance. For example, M/s Florence Metal Plating Company is one such company whose main strategies are joint ventures with manufacturers, research institutes, and regulatory agencies to keep abreast of technology changes as well as legislation on the environment. A company's competitiveness in the market is boosted by its ability to offer specialized plating solutions like decorative plating, hard chrome plating, zinc-nickel alloy plating, etc. Consumer preferences and environmental consciousness also influence market dynamics. Moreover, end users prefer automated machinery that can be easily maintained, and they have started prioritizing sustainable manufacturing procedures following intensifying campaigns on green energy policies. Among this includes global trends such as circular economy initiatives that are influencing the Europe Metal Plating and Finishing Market. The movement toward a circular economy that involves reusing, recycling, and repurposing products and materials has implications for the metal finishing industry. These companies intend to align themselves with these new principles through closed-loop systems, such as recycling solutions within their plants, to minimize the ecological footprint of metal plating processes.

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Leave a Comment