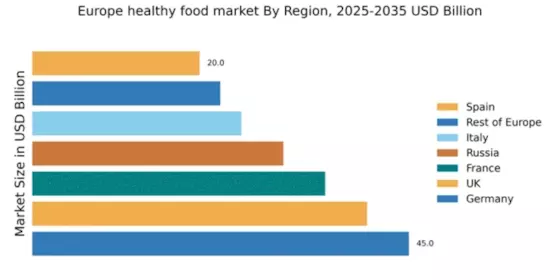

Germany : Strong Demand and Innovation Drive Growth

Key markets include Berlin, Munich, and Hamburg, where urban populations are increasingly favoring healthy options. The competitive landscape features major players like Nestle and Danone, who are investing in local production. The business environment is favorable, with a strong emphasis on sustainability and innovation. The organic food sector is particularly vibrant, with local farmers and producers gaining traction in the market.

UK : Consumer Trends Shape Market Dynamics

Key markets include London, Manchester, and Birmingham, where demand for organic and free-from products is particularly high. Major players like Unilever and PepsiCo are actively expanding their portfolios to meet consumer preferences. The competitive landscape is characterized by a mix of established brands and innovative startups, fostering a dynamic business environment. The plant-based food sector is rapidly growing, reflecting changing dietary habits.

France : Culinary Heritage Meets Modern Trends

Key markets include Paris, Lyon, and Marseille, where consumers are increasingly seeking organic and locally sourced foods. Major players like Danone and Lactalis dominate the landscape, focusing on innovation and sustainability. The competitive environment is robust, with a mix of traditional and modern retailers. The organic dairy and plant-based sectors are particularly prominent, reflecting France's culinary heritage and evolving consumer preferences.

Russia : Growing Awareness and Demand Surge

Key markets include Moscow, St. Petersburg, and Kazan, where urban consumers are driving demand for organic and health-focused products. Major players like Coca-Cola and Nestle are expanding their offerings to cater to local tastes. The competitive landscape is becoming more dynamic, with local brands emerging alongside international giants. The demand for functional foods and beverages is on the rise, reflecting changing consumer preferences.

Italy : Tradition Meets Health Consciousness

Key markets include Milan, Rome, and Florence, where consumers are increasingly opting for organic and locally sourced foods. Major players like Barilla and Ferrero are adapting their product lines to meet health trends. The competitive landscape features a mix of traditional Italian brands and innovative startups. The organic pasta and olive oil sectors are particularly strong, reflecting Italy's culinary heritage and evolving consumer preferences.

Spain : Cultural Shifts Drive Demand

Key markets include Madrid, Barcelona, and Valencia, where urban consumers are increasingly seeking organic and health-focused products. Major players like Nestle and Unilever are expanding their offerings to cater to local tastes. The competitive landscape is becoming more dynamic, with local brands emerging alongside international giants. The demand for organic fruits and vegetables is on the rise, reflecting changing consumer preferences.

Rest of Europe : Varied Preferences Shape Healthy Food

Key markets include the Nordic countries, Benelux, and Eastern Europe, where demand for organic and health-focused products is rising. Major players like General Mills and Mondelez International are adapting their strategies to cater to local tastes. The competitive landscape is diverse, with a mix of established brands and local producers. The demand for gluten-free and plant-based products is growing, reflecting changing dietary habits across the region.