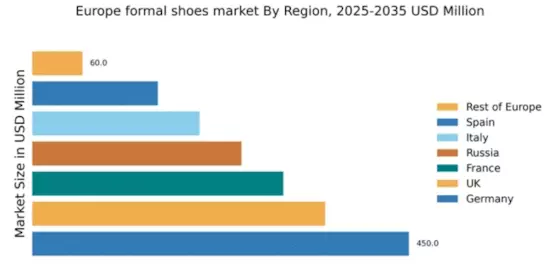

Germany : Strong Demand and Innovation Drive Growth

Germany holds a commanding market share of 37.5% in the European formal shoes market, valued at $450.0 million. Key growth drivers include a robust economy, increasing disposable incomes, and a growing preference for premium footwear. Demand trends indicate a shift towards sustainable materials and innovative designs. Regulatory policies promoting eco-friendly practices and government initiatives supporting local manufacturing further enhance market potential. Infrastructure development, particularly in logistics and retail, supports efficient distribution channels.

UK : Diverse Preferences Shape Consumer Choices

The UK formal shoes market accounts for 29.2% of the European market, valued at $350.0 million. Growth is fueled by fashion trends, with consumers increasingly seeking stylish yet comfortable options. The rise of e-commerce has transformed consumption patterns, allowing for greater accessibility. Regulatory frameworks support fair trade practices, while government initiatives encourage innovation in design and materials. The retail landscape is evolving, with a focus on omnichannel strategies to enhance customer experience.

France : Luxury and Craftsmanship Define Market

France captures 25% of the European formal shoes market, valued at $300.0 million. The market thrives on a rich heritage of craftsmanship and luxury branding, with consumers willing to invest in high-quality products. Growth drivers include a strong tourism sector and a rising interest in sustainable fashion. Regulatory policies emphasize quality standards, while government initiatives promote local artisans. Major cities like Paris and Lyon are key markets, showcasing a competitive landscape dominated by luxury brands and innovative designers.

Russia : Growing Middle Class Fuels Demand

Russia holds a 20.8% share of the European formal shoes market, valued at $250.0 million. The growth is primarily driven by an expanding middle class and increasing urbanization. Demand trends reflect a shift towards international brands and online shopping. Regulatory policies are evolving to support foreign investments, while government initiatives aim to boost local production. Key markets include Moscow and St. Petersburg, where competition is intensifying among both local and international players, creating a dynamic business environment.

Italy : Heritage Brands Dominate the Market

Italy represents 16.7% of the European formal shoes market, valued at $200.0 million. The market is characterized by a blend of traditional craftsmanship and modern design. Growth drivers include a strong export market and a focus on high-quality materials. Regulatory policies support artisanal production, while government initiatives promote Italian brands globally. Cities like Milan and Florence are pivotal, with a competitive landscape featuring renowned brands like Salvatore Ferragamo and Geox, catering to both domestic and international consumers.

Spain : Youthful Trends Drive Market Growth

Spain accounts for 12.5% of the European formal shoes market, valued at $150.0 million. The market is driven by youthful consumer trends and a growing interest in fashion-forward designs. E-commerce is rapidly gaining traction, reshaping consumption patterns. Regulatory policies encourage sustainable practices, while government initiatives support local designers. Key markets include Madrid and Barcelona, where competition is fierce among local brands and international players, fostering a vibrant retail environment.

Rest of Europe : Varied Preferences Shape Local Dynamics

The Rest of Europe holds a modest 5% share of the formal shoes market, valued at $60.0 million. Growth is driven by diverse consumer preferences across different countries. Regulatory policies vary significantly, impacting market entry for international brands. Government initiatives often focus on promoting local craftsmanship and sustainability. Key markets include smaller cities and regions where local brands thrive, creating a competitive landscape that is unique to each country, with varying levels of market maturity.