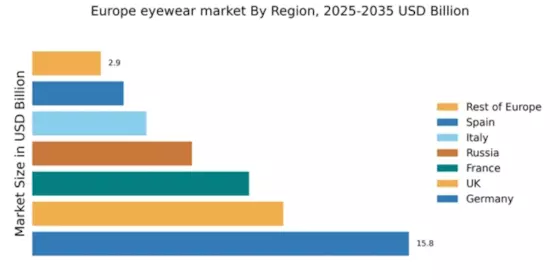

Germany : Strong Demand and Innovation Drive Growth

Germany holds a significant market share of 15.84% in the European eyewear sector, valued at approximately €4.5 billion. Key growth drivers include a rising aging population, increasing awareness of eye health, and a shift towards premium eyewear products. Regulatory policies promoting vision care and government initiatives supporting optical health have further stimulated demand. The country boasts a robust infrastructure, with advanced manufacturing capabilities and a well-established retail network.

UK : Fashion and Functionality in Eyewear

The UK eyewear market accounts for 10.56% of the European share, valued at around €3 billion. Growth is driven by fashion trends, the rise of online retail, and increasing disposable incomes. Consumers are increasingly opting for stylish frames and high-quality lenses. Regulatory frameworks ensure product safety and quality, while government initiatives support local manufacturers. The market is characterized by a blend of traditional and digital retail channels, enhancing accessibility.

France : Luxury Brands Shape Market Trends

France holds a 9.12% market share in the eyewear sector, valued at approximately €2.7 billion. The growth is fueled by the strong presence of luxury brands and a culture that values aesthetics. Demand for designer eyewear is on the rise, supported by government initiatives promoting local craftsmanship. The market is influenced by Paris as a fashion capital, with a focus on high-end retail experiences and innovative designs.

Russia : Increasing Demand for Quality Eyewear

Russia's eyewear market represents 6.72% of the European total, valued at about €1.9 billion. Key growth drivers include a growing middle class, increased health awareness, and a shift towards quality products. Regulatory policies are evolving to enhance consumer protection, while government initiatives aim to boost local production. The market is expanding in urban centers like Moscow and St. Petersburg, where demand for premium eyewear is rising.

Italy : Home to Renowned Eyewear Brands

Italy accounts for 4.8% of the European eyewear market, valued at approximately €1.4 billion. The country is known for its rich heritage in eyewear design and manufacturing, with major players like Luxottica and Safilo Group leading the market. Growth is driven by a strong export market and increasing domestic demand for stylish eyewear. Regulatory frameworks support innovation and quality standards, fostering a competitive environment.

Spain : Cultural Influences on Eyewear Choices

Spain's eyewear market holds a 3.84% share of the European market, valued at around €1.1 billion. Growth is driven by cultural trends favoring unique and fashionable eyewear. The government supports local manufacturers through favorable policies, while increasing health awareness drives demand for prescription eyewear. Key markets include Madrid and Barcelona, where a mix of local and international brands compete for consumer attention.

Rest of Europe : Emerging Trends Across Regions

The Rest of Europe accounts for 2.88% of the eyewear market, valued at approximately €800 million. This segment includes various countries with unique market dynamics and consumer preferences. Growth is driven by increasing urbanization and rising disposable incomes. Regulatory policies vary by country, impacting market entry for international brands. Local players often dominate, with a focus on affordable eyewear solutions tailored to regional tastes.