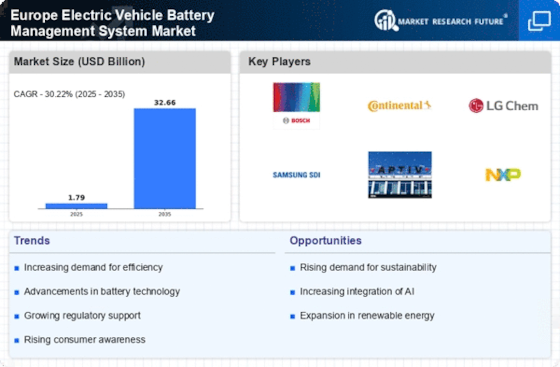

Top Industry Leaders in the Europe Electric Vehicle Battery Management System Market

The Competitive Landscape of the European Electric Vehicle Battery Management System Market

In the grand orchestra of Europe's transition to electric mobility, where clean engines hum the melody and sustainability harmonizes with innovation, the Battery Management System (BMS) acts as the vital conductor, ensuring the electric heart of each vehicle beats efficiently and safely. This dynamic market pulsates with intricate strategies, fierce competition, and the promise of powering Europe's ambitious journey towards a carbon-neutral future. Delving into this symphony requires discerning the approaches of key players, understanding market share nuances, and recognizing the emerging trends shaping its future rhythm.

Key Player:

- Denso Corporation

- Robert Bosch GmbH

- Panasonic Corporation

- LG Chem Ltd

- Calsonic Kansei Corporation

- Hitachi Automotive Systems Ltd

- Mitsubishi Electric Corporation

- Continental AG

- Lithium Balance

- Preh GmbH

Strategies Adopted by Leaders:

- Technology Prowess: Denso and Bosch lead the charge with advanced cell monitoring, thermal management, and safety systems, coupled with sophisticated data analytics platforms for optimal battery performance and longevity.

- Vertical Specialization: Hella focuses on specific vehicle segments like commercial EVs with customized BMS solutions, while Continental Automotive caters to high-performance applications with advanced battery packs and control algorithms.

- Partnership Play: Valeo collaborates with battery and software providers, fostering an ecosystem of integrated solutions and accelerating development cycles.

- Open-Source Platforms: The GENIVI Alliance promotes open-source software tools for EV components, including BMS, lowering entry barriers and empowering smaller players.

- Focus on User Experience and Transparency: Providing accessible data on battery health, range estimation, and charging progress through intuitive interfaces enhances user trust and engagement.

Factors for Market Share Analysis:

- System Capabilities and Performance: Companies offering BMS with high-precision cell balancing, efficient thermal management, and fast charging support command premium prices and secure market share by delivering extended battery life and optimal vehicle performance.

- Data Analytics and Connectivity: Robust software platforms with advanced data analysis algorithms for predicting battery health, optimizing charging cycles, and enabling remote monitoring are crucial for proactive maintenance and maximizing battery lifespan.

- Compliance and Safety Features: BMS adhering to stringent European safety regulations and providing advanced safeguards against overcharging, overheating, and cell failure are essential for market acceptance and user safety.

- Scalability and Adaptability: Solutions that can be easily adapted to different vehicle types, battery chemistries, and modular powertrain configurations are valuable for catering to diverse vehicle portfolios and future technology advancements.

- Cost Competitiveness and Affordability: Balancing advanced features with an attractive price point is crucial for capturing market share, particularly in cost-sensitive segments and emerging EV markets within Europe.

New and Emerging Companies:

- Startups like Octillion and GreenBean One: These innovators focus on affordable, cloud-based BMS solutions with AI-powered analytics and remote diagnostics, catering to cost-conscious automakers and fleet operators.

- Academia and Research Labs: The Fraunhofer Institute for Chemical Technology and the Technical University of Munich research next-generation BMS technologies like solid-state battery compatibility and advanced cell health monitoring algorithms, shaping the future of the market.

- Material Science Innovations: Companies like Saint-Gobain and Johnson Matthey develop advanced materials for battery cooling systems and cell separators, contributing to improved thermal management and performance.

Industry Developments:

Denso Corporation:

- November 2023, Announced partnership with a European car manufacturer to supply their advanced battery management system with cell-to-pack communication for improved efficiency and safety.

- July 2023, Acquired a European startup specializing in AI-powered battery management software, strengthening their analytics capabilities.

Robert Bosch GmbH:

- October 2023, Unveiled a new high-voltage battery management system with integrated thermal management for faster charging and extended battery life.

- June 2023, Partnered with a leading lithium-ion battery manufacturer to develop battery management systems optimized for their next-generation cells.