Market Trends

Key Emerging Trends in the Europe Blood Glucose Test Strip Packaging Market

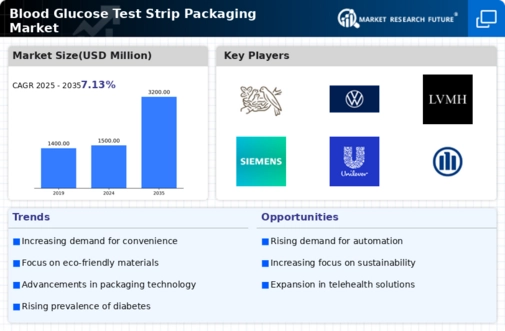

Producers are focusing in on making user-friendly packaging for blood glucose test strips to take care of a different segment, including old people. Helpful and simple to-open packaging, joined by clear directions, is acquiring unmistakable quality to guarantee precise and hassle-free testing for people overseeing diabetes day to day. The market is encountering a pattern towards customizable packaging solutions to meet individual patient requirements. Customized packaging upgrades the user experience as well as helps in better association and management of test strips, elevating adherence to ordinary checking schedules. smart packaging advancements, for example, temperature-touchy pointers and humidity control highlights, are getting some impetus in the blood glucose test strip packaging market. These advances assist with keeping up with the honesty of the test strips, guaranteeing exact outcomes and dependability for users. The developing reception of telehealth administrations has affected blood glucose test strip packaging patterns. Packaging that works with remote checking and telehealth meetings, permitting patients to share test results carefully with healthcare experts, is becoming more common on the lookout. As healthcare costs keep on being a worry, there is a rising interest for practical blood glucose test strip packaging solutions. Manufacturers are investigating ways of improving creation processes and diminish packaging costs while keeping up with great principles. The developing accentuation on natural supportability has prompted an expanded interest for eco-friendly packaging solutions. Producers in the Blood Glucose Test Strip Packaging market are investigating supportable materials and packaging plans to line up with worldwide natural worries.

Leave a Comment