Market Analysis

In-depth Analysis of Europe Advanced Biofuel market Industry Landscape

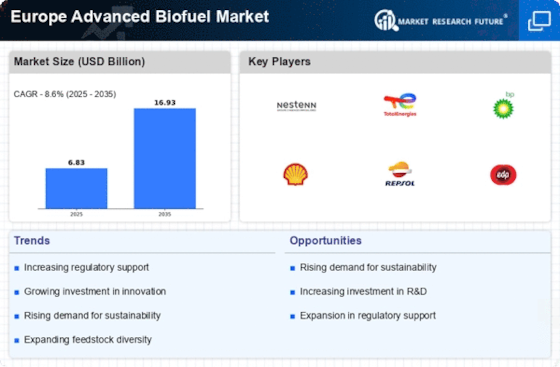

The European advanced biofuel market is experiencing dynamic shifts driven by various factors influencing supply, demand, and overall market conditions. In recent years, heightened environmental concerns, coupled with regulatory initiatives aimed at reducing carbon emissions, have spurred significant growth in the advanced biofuel sector across Europe. This growth trajectory is further fueled by increasing investments in research and development, as well as advancements in biofuel production technologies.

One of the key drivers shaping the market dynamics is the European Union's ambitious renewable energy targets. Through initiatives such as the Renewable Energy Directive (RED), the EU has set binding targets for the share of renewable energy in the overall energy mix, including transportation fuels. This has created a favorable regulatory environment that incentivizes the production and consumption of advanced biofuels, driving market growth.

Moreover, rising awareness among consumers about the environmental impact of traditional fossil fuels has led to a growing demand for cleaner and more sustainable alternatives. Advanced biofuels, derived from sources such as agricultural residues, waste biomass, and algae, offer a promising solution to mitigate greenhouse gas emissions while reducing reliance on finite fossil fuel resources. This increasing demand from both consumers and industries is driving investments in biofuel production infrastructure and stimulating market expansion.

Furthermore, the volatility of crude oil prices and geopolitical uncertainties in traditional oil-producing regions have underscored the importance of diversifying the energy supply chain. Advanced biofuels present an attractive option for enhancing energy security and reducing dependence on imported fossil fuels. As a result, governments and industry stakeholders are increasingly focusing on developing domestic biofuel production capabilities, thereby stimulating market growth and fostering economic resilience.

However, despite the favorable market conditions, the advanced biofuel industry in Europe faces several challenges that impact its dynamics. One of the primary challenges is the competition for feedstock resources, as the production of biofuels competes with other sectors such as food and feed production. This competition can lead to fluctuations in feedstock prices and supply chain uncertainties, affecting the overall profitability and sustainability of biofuel production.

Additionally, technological and infrastructural barriers pose challenges to the widespread adoption of advanced biofuels. While significant progress has been made in developing efficient biofuel production processes, scaling up these technologies to commercial levels remains a complex and costly endeavor. Moreover, the lack of adequate distribution infrastructure and refueling stations for biofuels presents logistical challenges that hinder market penetration and consumer adoption.

The European advanced biofuel market is characterized by dynamic shifts driven by regulatory frameworks, environmental concerns, and technological advancements. While favorable policies and growing demand are driving market expansion, challenges such as feedstock competition and infrastructural limitations pose significant hurdles to overcome. Addressing these challenges will be crucial for unlocking the full potential of advanced biofuels in Europe and accelerating the transition towards a more sustainable energy future.

Leave a Comment