Top Industry Leaders in the Ethylene Oxide Market

Ethylene oxide (EO), a crucial building block for countless everyday products, finds itself in a dynamic and competitive market characterized by a shifting landscape. understanding the current state of play is critical for anyone involved in this vital sector. So, buckle up as we delve into the intricate world of EO's competitive landscape, exploring strategies, key players, evolving trends, and the most recent developments shaping the market.

Ethylene oxide (EO), a crucial building block for countless everyday products, finds itself in a dynamic and competitive market characterized by a shifting landscape. understanding the current state of play is critical for anyone involved in this vital sector. So, buckle up as we delve into the intricate world of EO's competitive landscape, exploring strategies, key players, evolving trends, and the most recent developments shaping the market.

Market Strategies: Shaping the Ethylene Oxide Landscape

A multitude of strategies are employed by companies to navigate the competitive terrain. Vertical integration, where players control various stages of the production process, is favored by giants like Dow and BASF, maximizing profit and operational efficiency. Conversely, niche specialization offers an edge to smaller players like INEOS, focusing on specific EO derivatives like glycol ethers.

Technological innovation reigns supreme, with investments in direct oxidation of methane (DOM) promising cleaner and more efficient EO production. Companies like Shell and SABIC are spearheading this advancement, aiming to gain a sustainable edge. Strategic partnerships and acquisitions are also prevalent, with recent examples like Dow's purchase of Olin's EO assets consolidating market positions.

Factors Influencing Market Share: The Shifting Tide

-

Geographical Presence: Asia-Pacific, particularly China, dominates consumption and production, making regional presence crucial. -

Product Mix: Diversifying into high-value derivatives like polyether glycols and ethoxylates opens doors to lucrative segments. -

Production Efficiency: Optimizing operations and minimizing costs through technological advancements like catalyst innovations is key. -

Regulatory Landscape: Stringent environmental regulations and safety standards can impact production costs and market access.

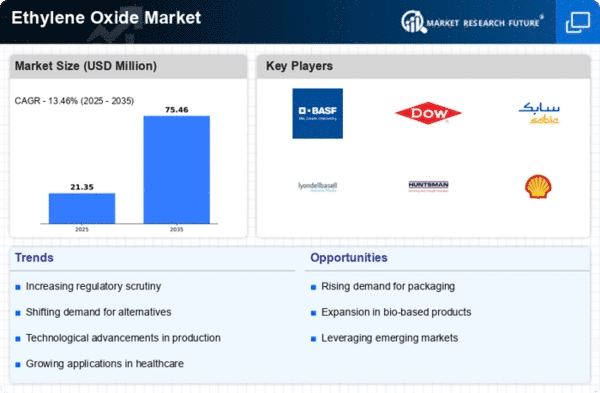

Key Players

- AKZO NOBEL N.V. (NETHERLANDS),

- BASF SE (GERMANY),

- CHINA PETROCHEMICAL CORPORATION (CHINA),

- CLARIANT (SWITZERLAND),

- DOWDUPONT (US),

- EXXON MOBIL CORPORATION (US),

- HUNTSMAN CORPORATION (US),

- INEOS (UK),

- LYONDELLBASELL INDUSTRIES HOLDINGS,

- B.V. (NETHERLANDS),

- ROYAL DUTCH SHELL PLC (NETHERLANDS),

- SABIC (SAUDI ARABIA),

- THE LINDE GROUP (US),

Recent Developments:

-

September 2023: India's Reliance Industries commences operations at its new EO/EG plant, boosting domestic production. -

October 2023: European EO prices stabilize after a turbulent summer, indicating a potential market correction. -

November 2023: LyondellBasell partners with a startup to develop bio-based EO technology, marking a significant step towards sustainable production. -

December 2023: China implements stricter environmental regulations for EO facilities, impacting production costs and potentially pushing smaller players out of the market.