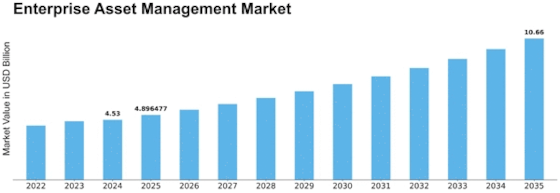

Enterprise Asset Management Size

Enterprise Asset Management Market Growth Projections and Opportunities

The Enterprise Asset Management (EAM) market is shaped by various market factors that influence its growth, adoption, and overall dynamics. Regulatory compliance stands out as a pivotal factor driving the EAM market. Industries across sectors are subject to stringent regulations governing asset management, maintenance, and reporting. The dynamic nature of regulatory requirements compels organizations to invest in EAM solutions that offer robust compliance capabilities, ensuring adherence to standards and minimizing regulatory risks. This market factor reflects the industry's commitment to meeting regulatory obligations and maintaining operational integrity.

Technological advancements play a fundamental role in shaping the EAM market. The continual evolution of technologies such as the Internet of Things (IoT), artificial intelligence (AI), and data analytics drives the sophistication of EAM systems. IoT sensors enable real-time data collection from assets, while AI-driven analytics enhance predictive maintenance capabilities. These technological advancements cater to the industry's demand for innovative solutions that optimize asset performance, reduce downtime, and facilitate more informed decision-making.

The demand for operational efficiency and cost optimization is a significant market factor influencing the adoption of EAM solutions. Organizations seek to maximize the lifespan of assets, minimize downtime, and optimize maintenance practices to reduce operational costs. EAM systems, with their ability to streamline asset management processes, enable proactive maintenance, and enhance resource allocation, align with the industry's pursuit of operational excellence and cost-effectiveness.

The global nature of business operations and the need for standardized asset management practices contribute to the market factors in EAM. Organizations with diverse geographical footprints seek EAM solutions that can provide a standardized approach to asset management across locations. This factor emphasizes the industry's recognition of the importance of consistency and uniformity in managing assets on a global scale, supporting streamlined operations and decision-making.

Data security and privacy considerations are paramount market factors in the EAM landscape. As organizations manage sensitive asset-related data, ensuring the security and confidentiality of this information becomes crucial. EAM solutions must incorporate robust cybersecurity measures to protect against data breaches and unauthorized access. This market factor reflects the industry's commitment to maintaining the integrity of asset data and addressing concerns related to data security and privacy compliance.

The shift towards a more sustainable and environmentally conscious approach to business operations is influencing EAM practices. Organizations integrate sustainability metrics into their asset management strategies, tracking energy consumption, emissions, and environmental impacts. EAM solutions evolve to support sustainable practices, aligning with the industry's commitment to corporate social responsibility and environmental stewardship.

The talent gap in asset management expertise poses a notable challenge and market factor for the EAM industry. While the demand for skilled professionals with expertise in EAM systems is on the rise, there is a shortage of qualified talent. Organizations address this challenge through training programs, partnerships with educational institutions, and collaboration with EAM solution providers. This market factor underscores the industry's proactive efforts to bridge the talent gap and cultivate a workforce capable of effectively utilizing EAM technologies.

Market consolidation and mergers and acquisitions (M&A) activities contribute to the market factors in the EAM landscape. As the EAM market matures, larger players seek to expand their market share and capabilities through strategic acquisitions. This trend reflects the industry's pursuit of growth, innovation, and the consolidation of complementary technologies to offer comprehensive EAM solutions.

The need for scalability and adaptability is a critical market factor in EAM adoption. Organizations require EAM solutions that can scale with their evolving business needs, accommodate growing volumes of asset data, and adapt to changes in industry practices. This factor highlights the industry's emphasis on flexibility and the ability of EAM systems to evolve alongside dynamic business environments.

Leave a Comment