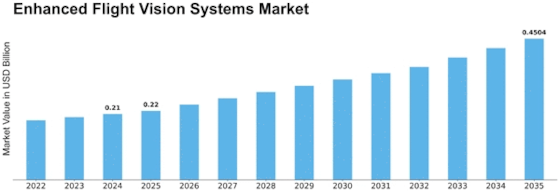

Enhanced Flight Vision Systems Size

Enhanced Flight Vision Systems Market Growth Projections and Opportunities

The Enhanced Flight Vision Systems (EFVS) market is undergoing significant developments driven by various market factors that profoundly influence its dynamics. A key catalyst for this market is the continuous advancement of aviation technology, particularly in the realm of cockpit systems and avionics. EFVS, utilizing technologies like infrared sensors and synthetic vision systems, enhances pilots' situational awareness during low-visibility conditions, such as fog or low clouds. As the aviation industry prioritizes safety and operational efficiency, the demand for EFVS-equipped aircraft continues to grow, making it a pivotal element of modern cockpit systems.

Technological advancements play a pivotal role in shaping the market factors of Enhanced Flight Vision Systems. Continuous innovations in sensor technologies, image processing, and display systems contribute to the development of more sophisticated and effective EFVS solutions. High-resolution sensors, real-time data processing capabilities, and advanced display interfaces enable pilots to navigate and land in challenging weather conditions with improved clarity and precision.

Globalization and international collaboration are significant influencers of the market dynamics of Enhanced Flight Vision Systems. The aviation industry operates on a global scale, with airlines and aircraft manufacturers having a presence in various regions. International standards and collaboration among aviation authorities facilitate the adoption and certification of EFVS technologies worldwide, allowing for consistent and widespread use across different regions and airline fleets.

Regulatory standards and certification processes are integral market factors for Enhanced Flight Vision Systems. Aviation regulatory bodies, such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA), play a crucial role in establishing the guidelines and certification requirements for EFVS-equipped aircraft. Compliance with these standards is essential for manufacturers and operators, influencing the development and adoption of EFVS technologies.

Cost considerations are fundamental in shaping the market dynamics of Enhanced Flight Vision Systems. While EFVS provides enhanced safety and operational benefits, the aviation industry operates within budget constraints. Aircraft manufacturers and operators evaluate the cost-effectiveness of integrating EFVS into their fleets, considering factors such as installation costs, training expenses, and the overall return on investment in terms of improved safety and operational efficiency.

Innovation and competition drive advancements in the Enhanced Flight Vision Systems market. Manufacturers and technology providers continually invest in research and development to improve the performance, capabilities, and integration of EFVS technologies. The competitive landscape encourages innovation, leading to the development of more compact, lightweight, and cost-effective EFVS solutions that cater to the diverse needs of different aircraft types.

Environmental sustainability considerations are emerging as factors influencing the market dynamics of Enhanced Flight Vision Systems. As the aviation industry faces increasing scrutiny regarding its environmental impact, EFVS technologies contribute to sustainability by improving operational efficiency and reducing the likelihood of flight diversions or delays due to adverse weather conditions. EFVS-enabled landings can enhance fuel efficiency and contribute to overall environmental performance.

Collaboration with airlines and pilot training organizations is critical for the market dynamics of Enhanced Flight Vision Systems. Training programs and operational procedures need to be adapted to incorporate EFVS technologies effectively. Collaboration among industry stakeholders ensures that pilots receive adequate training, standard operating procedures are updated, and the integration of EFVS into existing operational frameworks is seamless.

Leave a Comment