Increased Risk Awareness

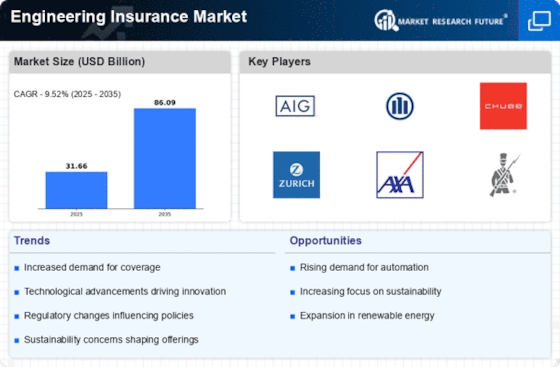

There is a growing awareness of risks associated with engineering projects, which is driving demand within the Engineering Insurance Market. Stakeholders, including contractors and project owners, are increasingly recognizing the potential financial implications of project failures, accidents, and natural disasters. This heightened risk awareness is prompting organizations to invest in comprehensive insurance solutions to safeguard their interests. According to recent data, the frequency of claims related to engineering projects has risen, further emphasizing the necessity for robust insurance coverage. As a result, the engineering insurance sector is likely to see sustained growth as entities prioritize risk management.

Technological Advancements

Technological advancements are reshaping the Engineering Insurance Market, as innovative tools and methodologies enhance project execution and risk management. The integration of artificial intelligence, machine learning, and data analytics allows insurers to assess risks more accurately and tailor policies to meet specific project needs. For example, the use of drones for site inspections and monitoring can significantly reduce the likelihood of accidents, thereby influencing insurance premiums. As technology continues to evolve, it is likely that the engineering insurance landscape will adapt, offering more customized solutions that align with the complexities of modern engineering projects.

Rising Infrastructure Investments

The Engineering Insurance Market is experiencing a notable surge in infrastructure investments across various sectors, including transportation, energy, and urban development. Governments and private entities are increasingly allocating substantial budgets to enhance and modernize infrastructure, which inherently raises the demand for engineering insurance. For instance, the construction sector alone has seen investments exceeding several trillion dollars, necessitating comprehensive insurance coverage to mitigate risks associated with project delays, accidents, and unforeseen events. This trend indicates a robust growth trajectory for the engineering insurance sector, as stakeholders seek to protect their investments and ensure project continuity.

Regulatory Compliance and Standards

The Engineering Insurance Market is significantly influenced by evolving regulatory compliance and standards that govern engineering practices. As governments and regulatory bodies implement stricter guidelines to ensure safety and quality, the demand for engineering insurance is likely to increase. Companies are compelled to adhere to these regulations, which often require them to obtain adequate insurance coverage to mitigate potential liabilities. This trend is particularly relevant in sectors such as construction and manufacturing, where compliance failures can result in substantial financial losses. Consequently, the engineering insurance market is poised for growth as organizations seek to navigate the complexities of regulatory landscapes.

Sustainability and Green Initiatives

The Engineering Insurance Market is witnessing a shift towards sustainability and green initiatives, as more projects aim to meet environmental standards and regulations. This trend is particularly evident in sectors such as renewable energy and sustainable construction, where insurance products are being tailored to address the unique risks associated with eco-friendly projects. Insurers are increasingly developing policies that consider environmental impacts, which may lead to lower premiums for projects that adhere to sustainable practices. As the demand for green engineering solutions continues to rise, the insurance market is expected to evolve, offering innovative products that align with these initiatives.