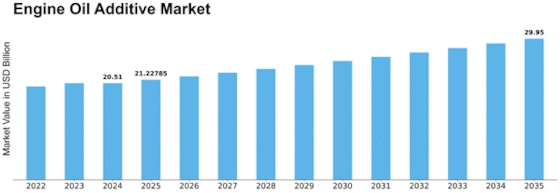

Engine Oil Additive Size

Engine Oil Additive Market Growth Projections and Opportunities

The Global market for Engine Oil Additives is subject to various market aspects that altogether impact its development and conditions. The development of the automotive field is a vital propelling aspect of the Global market for Engine Oil Additives. As the worldwide number of automobiles on roads grows, there is an unmatched increase in the demand for engine oil additives. They are considered to be crucial to preserving engine efficacy and extending the lifespan of automobiles.

Spurring environmental worries and controlling events have caused the execution of Strict release norms internationally. Engine oil additives act as a vital part of developing fuel efficiency and lowering emissions. This amplified focus on ecological sustainability has become a sizable parameter in modelling the market.

Constant research and development attempts have resulted in technological developments in the formulation of engine oil additives. Innovations such as viscosity index improvers, advanced friction modifiers, and anti-wear additives are providing advancement to the market by enhancing engine performance and fuel effectiveness.

The median age of automobiles in action has been spurring, leading to a superior requirement for maintenance and performance-attractive products like engine oil additives. Aged automobiles regularly experience enriched wear and tear, making them fundamental for improving engine function and avoiding premature engine failure.

Escalating awareness among users about the benefits of engine oil additives is impacting purchasing decisions. Manufacturers and distributors are investing in educational campaigns to highlight the part of additives in engine protection, fuel efficiency, and overall vehicle performance.

The market is undergoing a move towards the adoption of synthetic and high-performance engine oils. These oils often require specialized additives to meet the demands of modern engines. As vehicle owners progressively choose premium lubricants, the demand for corresponding high-quality additives is on the rise.

Governments across the globe are actively stimulating energy efficiency and sustainability. In this context, engine oil additives influence the efficiency of engines, lowering fuel consumption and, consequently, greenhouse gas emissions. Encouraging government policies and incentives for energy-efficient solutions positively impacts the market.

Collaboration among prime field participants, encompassing oil businesses, additive manufacturers, and automotive OEMs, is an extraordinary market parameter. Partnerships facilitate the development of inventive additives and ensure their compatibility with specific engine types, fostering a more comprehensive and integrated approach to engine care.

The Global market for Engine Oil Additives is recognized by intense competition, prompting businesses to engage in mergers, acquisitions, and partnerships to strengthen their market position. Market competitiveness drives continuous innovation and the launch of new and better additives to meet evolving consumer and field demands.

Leave a Comment