Market Trends

Key Emerging Trends in the Energy Storage System ESS Battery Management System BMS Market

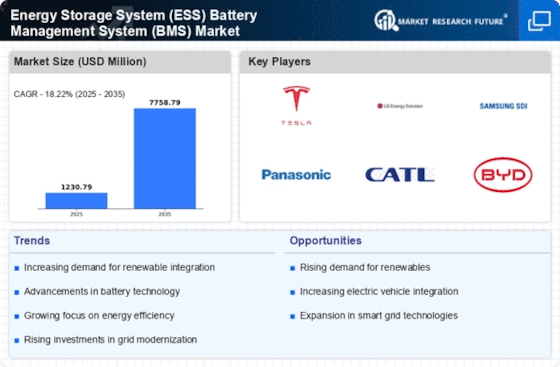

The global demand for energy storage features several trends including the ESS BMS market that is largely propelled by securing every revenue-worthy opportunity worldwide. ESS is an emerging player offering BMS solutions that build up on advanced tech use of the current generation in order to effectively manage batteries throughout a number of areas, such as renewable energy mixes or further grid stability installations. A fascinating trend emerging in the ESS BMS Market includes large-scale lithium-ion batteries deployment. As the world saw an increasing need for renewable energy such as solar and wind, li-ion batteries became a popular choice for storing energy because of their higher appetite, proofs in years to come, fasters charge rates. The lithium-ion batteries find use in a diverse range of applications where the ESS BMS is interacting as per the trend, to provide specialized battery management systems that make the most out of these cells. In the process of shifting to a more renewable-energy based grid system, grid-scale energy storage systems are coming into focus. Such development is emerging due to this trend, which requires innovative and sound BMS technologies supporting large-scale ESS projects. The attention on modular and scalable topology in BMS design is growing steadily as it is applicable for grid scale applications with different generating capacities. These systems ensure easy management of renewable energy sources and improves stability and reliability of the grids.

One of the fuelers for the ESS BMS market is the EV market. There has been a great increase in the demand for advanced battery management systems due to the rise of electric vehicles on high performance value-added applications, with safety being a core issue since they are used for high voltage levels. With respect to BMS technologies, they are crucial in this regard given that the same facilitate extensive monitoring and load balancing of individual cells within a battery pack besides influencing charge and discharge processes as well as providing real-time data for increased vehicle efficiency. In the ESS BMS market, a growing practice is AI and ML algorithms integration. The technologies help BMS systems to read and analyze data patterns, predicting battery behaviour based on performance changes by developing artificial intelligence (AI) models to serve as input for software algorithms that are used in optimizing the use of energy. The AI-driven BMS solutions that the energy storage systems apply increase in overall efficiency, predictive maintenance, and system reliability as these features allow them to adapt better to changing demands for energy.

Leave a Comment