Increasing Healthcare Expenditure

The rise in healthcare expenditure across various regions is a significant driver for the Endoscopy Device Market. Governments and private sectors are investing more in healthcare infrastructure, leading to improved access to advanced medical technologies. This increase in funding allows healthcare facilities to acquire state-of-the-art endoscopic devices, enhancing their diagnostic and treatment capabilities. Market analysis indicates that healthcare spending is expected to grow at a rate of 5% annually, which will likely result in a higher adoption rate of endoscopic technologies. As healthcare systems evolve, the demand for efficient and effective endoscopic solutions will continue to rise, contributing to the overall growth of the market.

Expansion of Outpatient Surgical Centers

The proliferation of outpatient surgical centers is emerging as a key driver for the Endoscopy Device Market. These facilities are increasingly adopting endoscopic procedures due to their efficiency and cost-effectiveness. The shift towards outpatient care is driven by patient preferences for convenience and shorter recovery times. Market trends indicate that outpatient surgical centers are expected to grow at a rate of 7% annually, leading to a higher demand for endoscopic devices. This trend not only enhances patient access to necessary procedures but also encourages the development of innovative endoscopic technologies tailored for outpatient settings. As these centers continue to expand, they will play a pivotal role in shaping the future of the endoscopy market.

Technological Innovations in Endoscopy Devices

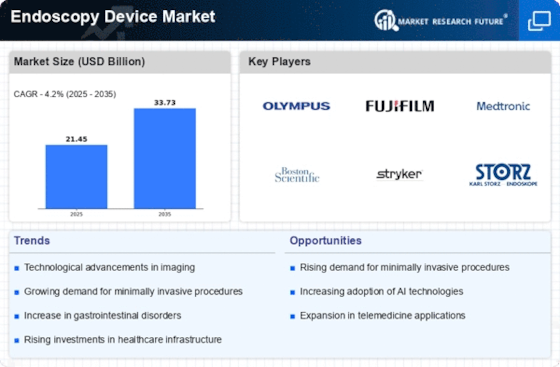

Technological advancements play a crucial role in shaping the Endoscopy Device Market. Innovations such as high-definition imaging, robotic-assisted endoscopy, and capsule endoscopy have revolutionized diagnostic capabilities. These advancements enhance visualization and precision, allowing for more accurate diagnoses and improved patient safety. The integration of artificial intelligence in endoscopic procedures is also gaining traction, potentially streamlining workflows and reducing the risk of human error. As healthcare facilities increasingly adopt these cutting-edge technologies, the market is expected to expand, with a projected increase in the adoption rate of advanced endoscopic devices. This trend indicates a shift towards more sophisticated and efficient endoscopic solutions.

Growing Demand for Minimally Invasive Surgeries

The rising preference for minimally invasive surgeries is significantly influencing the Endoscopy Device Market. Patients and healthcare providers alike favor these procedures due to their associated benefits, including reduced recovery times, lower risk of complications, and minimal scarring. As a result, there is a growing demand for endoscopic devices that facilitate such surgeries. Market data suggests that the minimally invasive surgery segment is expected to witness substantial growth, with projections indicating a market share increase of approximately 30% over the next five years. This shift towards less invasive techniques is likely to drive innovation and investment in endoscopic technologies, further propelling market expansion.

Rising Prevalence of Gastrointestinal Disorders

The increasing incidence of gastrointestinal disorders, such as colorectal cancer and inflammatory bowel disease, is a primary driver for the Endoscopy Device Market. According to recent statistics, colorectal cancer is one of the most common cancers worldwide, leading to a heightened demand for diagnostic and therapeutic endoscopic procedures. This trend is further supported by the aging population, which is more susceptible to such conditions. As healthcare providers seek to improve patient outcomes, the adoption of advanced endoscopic devices becomes essential. The market is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 6% in the coming years, driven by the need for early detection and minimally invasive treatment options.