Growing Prevalence of Gastrointestinal Disorders

The rising incidence of gastrointestinal disorders is a key driver for the Endoscopic Ultrasound Needles Market. Conditions such as pancreatitis, gastrointestinal cancers, and other related diseases necessitate accurate diagnostic tools for effective management. According to recent statistics, the prevalence of pancreatic cancer is expected to rise, leading to a greater demand for endoscopic ultrasound procedures. This trend underscores the importance of endoscopic ultrasound needles in providing minimally invasive diagnostic options. As healthcare systems strive to improve patient care and outcomes, the demand for these specialized needles is anticipated to increase, further propelling market growth.

Increasing Investment in Healthcare Infrastructure

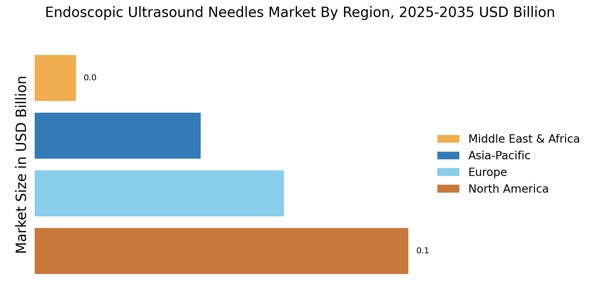

Investment in healthcare infrastructure is a significant driver for the Endoscopic Ultrasound Needles Market. Governments and private entities are allocating substantial resources to enhance healthcare facilities, particularly in developing regions. This investment is aimed at improving diagnostic capabilities and expanding access to advanced medical technologies. As healthcare systems evolve, the demand for endoscopic ultrasound needles is expected to rise, driven by the need for effective diagnostic tools in newly established facilities. The expansion of healthcare infrastructure is likely to create new opportunities for market players, fostering innovation and competition within the industry.

Shift Towards Minimally Invasive Surgical Techniques

The Endoscopic Ultrasound Needles Market is benefiting from a notable shift towards minimally invasive surgical techniques. Patients and healthcare providers alike are increasingly favoring procedures that reduce recovery time and minimize surgical trauma. Endoscopic ultrasound needles play a pivotal role in this transition, offering a less invasive alternative for obtaining tissue samples and diagnosing conditions. The market is likely to see a rise in adoption rates as more healthcare facilities invest in training and equipment to support these techniques. This shift not only enhances patient satisfaction but also aligns with broader trends in healthcare that prioritize efficiency and safety.

Rising Awareness and Education on Diagnostic Procedures

The Endoscopic Ultrasound Needles Market is witnessing a rise in awareness and education regarding diagnostic procedures among both healthcare professionals and patients. Increased training programs and workshops are being conducted to familiarize practitioners with the benefits and applications of endoscopic ultrasound techniques. This heightened awareness is likely to lead to greater acceptance and utilization of endoscopic ultrasound needles in clinical practice. As patients become more informed about their treatment options, the demand for these advanced diagnostic tools is expected to grow, further driving market expansion.

Technological Innovations in Endoscopic Ultrasound Needles

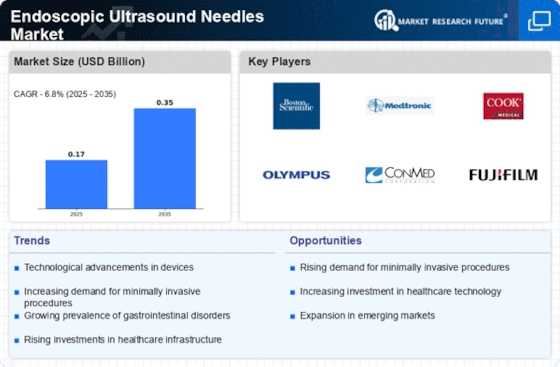

The Endoscopic Ultrasound Needles Market is experiencing a surge in technological innovations that enhance the precision and efficacy of procedures. Advancements in needle design, such as the introduction of fine-needle aspiration (FNA) and core biopsy needles, are improving diagnostic capabilities. These innovations are likely to lead to better patient outcomes and increased adoption rates among healthcare professionals. Furthermore, the integration of imaging technologies with endoscopic ultrasound needles is facilitating real-time visualization, which is crucial for accurate targeting of lesions. As a result, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 6.5% over the next few years, reflecting the increasing reliance on advanced technologies in medical procedures.