Top Industry Leaders in the End Load Cartoning Machine Market

*Disclaimer: List of key companies in no particular order

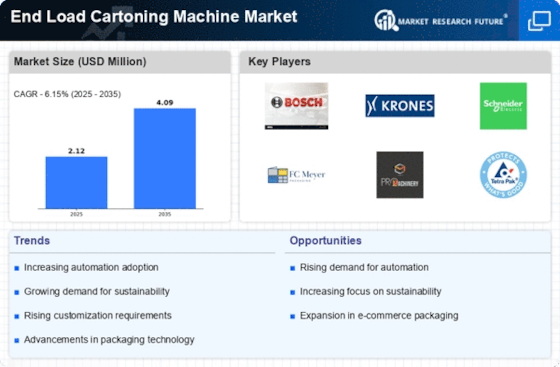

Top listed global companies in the End Load Cartoning Machine industry are:

Robert Bosch Packaging Technology GmbH (Germany), Omori Machinery Co., Ltd (Japan), Molins PLC (UK), ROVEMA GmbH (Germany), EconoCorp Inc. (US), PMI Cartoning, Inc. (US), Langley Holdings PLC (UK), ADCO Manufacturing (US), Tetra Pak International S.A. (Switzerland), and Marchesini Group (Italy)

Bridging the Gap by Exploring the Competitive Landscape of the End Load Cartoning Machine Top Players

The end load cartoning machine market is thriving, fueled by automation demands across industries like food & beverage, pharmaceuticals, and consumer goods. Understanding the intricate competition within this landscape is crucial for stakeholders to thrive. This analysis delves into key player strategies, market share determinants, emerging trends, and the overall competitive scenario.

Key Players and Their Strategies:

- Global Giants: Bosch Packaging Technology, IMA Group, and Marchesini Group dominate the market with comprehensive product portfolios catering to diverse packaging needs. Their strategies revolve around continuous R&D, strategic acquisitions, and global expansion, solidifying their leadership positions.

- Regional Players: ACG Worldwide, IWK Verpackungstechnik, and ROVEMA GmbH carve niches through regional expertise and cost-effective solutions. They prioritize customization, build strong customer relationships, and leverage regional regulations to compete effectively.

- Emerging Players: New entrants like Omori Machinery and Douglas Machine are disrupting the market with innovative offerings like modular designs and AI-powered machine vision. Their agility, focus on specific segments, and competitive pricing strategies enable them to gain traction.

Factors Driving Market Share Analysis:

- Product Portfolio Breadth: Offering a variety of horizontal and vertical end load cartoning machines catering to different production capacities and product types is key. Players like Bosch excel in this aspect, providing solutions for high-volume to niche applications.

- Technological Advancements: Integration of robotics, servo-driven systems, and intelligent controls enhances machine efficiency, flexibility, and data-driven optimization. IMA Group's focus on Industry 4.0 integration is a prime example of this trend.

- Sustainability Initiatives: Eco-friendly features like reduced energy consumption and biodegradable materials are gaining traction. Marchesini Group's emphasis on sustainable packaging solutions resonates with environmentally conscious consumers.

- After-Sales Service Network: Reliable and responsive maintenance and support services are crucial for customer satisfaction and brand loyalty. ROVEMA GmbH's extensive global service network exemplifies this commitment.

Emerging Trends and Player Responses:

- Smart Packaging Integration: Integrating end load cartoning machines with serialization and track & trace technologies for enhanced product safety and regulatory compliance is a growing trend. Bosch's Track & Trace system is a testament to this.

- E-commerce Fulfillment: The rise of e-commerce demands adaptable machines for smaller order sizes and faster turnaround times. ACG Worldwide's modular cartoning solutions cater specifically to this segment.

- Data-Driven Insights and Predictive Maintenance: Leveraging machine data for real-time performance monitoring and predictive maintenance is gaining momentum. Douglas Machine's AI-powered maintenance platform exemplifies this trend.

Overall Competitive Scenario:

The end load cartoning machine market is characterized by intense competition, with players vying for market share through differentiation, innovation, and strategic partnerships. While established players leverage their brand recognition and extensive portfolios, regional and emerging players are carving niches with cost-effectiveness, customization, and agility. Technological advancements, sustainability initiatives, and e-commerce fulfillment are shaping the future, demanding adaptable and data-driven solutions. Success in this market will hinge on the ability to cater to evolving customer needs, embrace technological disruptions, and prioritize both efficiency and environmental responsibility.

Latest Company Updates:

Robert Bosch Packaging Technology: Launched the SVC 2520 end-load cartoner in 2023, featuring high speed and flexibility for small to medium-sized products. (Source: Bosch Packaging Technology website, press release dated June 15, 2023)

Omori Machinery Co., Ltd: Developed a new series of servo-driven end-load cartoners with improved accuracy and efficiency. (Source: Omori Machinery website, product brochure)

Molins PLC: Announced a partnership with a leading robotics company to develop automated loading systems for its end-load cartoners. (Source: Molins PLC press release dated November 1, 2023)

ROVEMA GmbH: Unveiled a new generation of modular end-load cartoners that can be easily customized to meet specific production requirements. (Source: Rovema website, press release dated September 5, 2023)

EconoCorp Inc.: Focused on offering affordable and reliable end-load cartoning machines for small and medium-sized businesses. (Source: EconoCorp website)