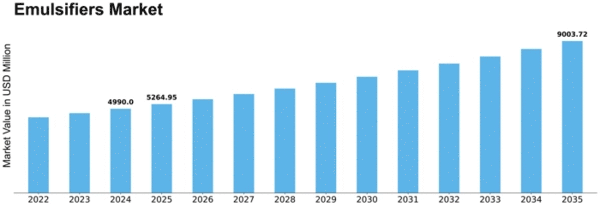

Emulsifiers Size

Emulsifiers Market Growth Projections and Opportunities

The Emulsifiers market is shaped by a myriad of factors that collectively influence its dynamics. Understanding these elements is crucial for industry participants to make informed decisions and navigate the market effectively.

Food and Beverage Industry Trends:

Emulsifiers play a vital role in the food and beverage industry, contributing to product stability, texture, and shelf life. Market dynamics are closely tied to trends in food processing and consumer preferences, with innovations in the industry influencing the demand for specific emulsifiers. Cosmetics and Personal Care Products:

Emulsifiers are widely used in the formulation of cosmetics and personal care products to achieve stable and aesthetically pleasing textures. The growth of the cosmetics industry and changing consumer preferences for skincare and beauty products impact the demand for emulsifiers. Pharmaceutical Applications:

Emulsifiers find applications in the pharmaceutical industry for the formulation of medications and topical products. Market dynamics are influenced by the pharmaceutical sector's growth, with increasing demand for emulsifiers in drug delivery systems and topical formulations. Surfactant Properties:

Emulsifiers often exhibit surfactant properties, making them crucial in various industrial processes, including agrochemicals and textiles. The demand for emulsifiers in industrial applications is influenced by trends in manufacturing and the use of surfactants for diverse purposes. Health and Wellness Trends:

The health and wellness movement influences the formulation of food and personal care products, driving the demand for emulsifiers with natural and sustainable attributes. Market dynamics are impacted by consumer preferences for clean-label products and environmentally friendly emulsifiers. Regulatory Compliance:

Stringent regulations in the food, cosmetics, and pharmaceutical industries regarding ingredient safety and labeling impact the selection and use of emulsifiers. Compliance with regulatory standards is crucial for manufacturers to ensure market acceptance and sustain a positive industry image. Clean Label Products:

The trend towards clean label products, free from synthetic additives, influences the demand for natural emulsifiers derived from sources such as plant extracts. Companies focusing on clean label formulations gain a competitive advantage in the market. Technological Advancements:

Ongoing advancements in emulsification technologies and the development of novel emulsifiers impact market dynamics. Companies investing in research and development to enhance emulsifier performance and versatility can gain a competitive edge. Global Economic Conditions:

Economic stability and growth rates in major economies influence consumer spending patterns and industrial activities, thereby affecting the demand for emulsifiers. Economic downturns may lead to shifts in consumer preferences and reduced demand for certain emulsifier-containing products. Packaged Food Industry Growth:

The growth of the packaged food industry, driven by convenience and changing lifestyles, directly influences the demand for emulsifiers. Emulsifiers contribute to the stability and texture of various packaged food products, making their demand closely linked to the performance of this industry. Brand Differentiation and Innovation:

Intense competition among emulsifier manufacturers encourages innovation in product formulations and applications. Companies that differentiate their products through unique formulations, improved functionalities, and tailored solutions can stand out in a competitive market. Supply Chain Dynamics:

The emulsifiers market is part of a global supply chain, and disruptions due to factors such as raw material availability or transportation challenges can impact pricing and availability. Ensuring supply chain resilience and diversifying sources become critical strategies for market participants.

Leave a Comment