- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

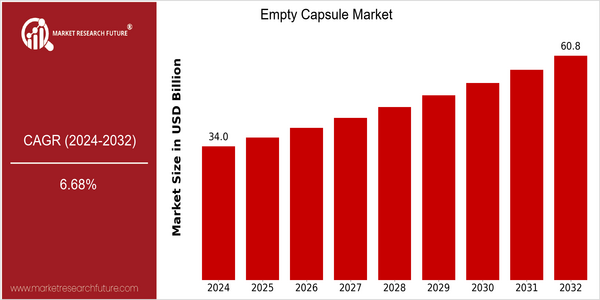

Empty Capsule Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 33.99 Billion |

| 2032 | USD 60.78 Billion |

| CAGR (2024-2032) | 6.68 % |

Note – Market size depicts the revenue generated over the financial year

The capsules market is expected to grow at a substantial rate, and will reach a value of $33,999,000,100 by 2024, which will rise to $57,800,000,000 by 2032. The growth will be accompanied by a sluggish but steady CAGR of 6.68%. The growing demand for food supplements and the rising number of chronic diseases have fueled the demand for effective drug delivery systems, which has pushed the empty capsules market. The development of new capsules such as vegetarian and gelatin capsules has also accelerated the growth of the capsules market. Moreover, the introduction of modified-release capsules has enhanced the effectiveness of pharmaceutical products. Several companies, such as Capsugel (now Lonza), Qualicaps, and ACG Worldwide, have also been working on strategic initiatives, such as the establishment of strategic alliances and the launch of new products, in order to enhance their market positions and meet the needs of consumers. These factors are expected to push the capsules market in the coming years.

Regional Deep Dive

The Empty Capsules Market is experiencing significant growth in different regions, owing to increasing demand for dietary supplements, pharmaceuticals, and advancements in capsule technology. North America is characterized by strong presence of key manufacturers and rising demand for vegetarian and gelatin capsules. Europe has stringent regulations that promote innovation, while ensuring product safety. Asia-Pacific is growing rapidly due to increasing health awareness and a growing pharmaceutical industry. The Middle East and Africa are gradually developing, influenced by rising investments in the healthcare sector. Latin America is emerging as a potential market, owing to the rise in disposable incomes and health awareness.

North America

- The North American market is witnessing a shift towards capsules made of plant material. Capsugel (now part of Lonza) is at the forefront of the development of vegetarian capsules to meet the growing needs of the growing number of vegetarians and vegans.

- This new development is due to the fact that the regulatory framework of the FDA is encouraging innovation in the formulation of capsules, in particular in the field of drug delivery systems, which will increase the efficacy of drugs.

- Amazon is one of the main suppliers of empty capsules.

Europe

- The strict regulations of the European Medicines Agency (EMC) ensure that all the empty capsules meet high quality and safety standards and therefore ensure confidence in consumers.

- Qualicaps has developed a capsule with an enteric coating, which makes it possible to administer the medicine with precision and improve compliance.

- In Europe, the demand for capsules is increasing, because of the growing trend of individualized medicine. Many companies are now offering capsules that can be tailored to the individual’s needs.

Asia-Pacific

- In the Asia-Oceania region, the capsule market is growing rapidly, driven by the expansion of the pharmaceutical industry, especially in countries such as India and China, where companies such as ACG Worldwide are strong.

- The 'Make in India' programme is a government initiative to boost the manufacturing industry, including pharmaceuticals. Empty capsules are being manufactured locally.

- The rising occurrence of lifestyle diseases in the region has led to a growing demand for dietary supplements, which in turn is driving the empty capsule market.

MEA

- In the Middle East and Africa, the capsules market is growing at a moderate pace, but governments are increasing their spending on health care and the resulting demand for capsules is expected to grow.

- Besides, the presence of the foreign companies, such as Capsugel and Suheung, will promote the development of the industry, and enhance the technological content of the industry.

- The use of dietary supplements and herbal medicines, especially in the United Arab Emirates and South Africa, is influencing the demand for empty capsules.

Latin America

- Latin America is seeing a growing health awareness among consumers, which has led to a rise in demand for dietary supplements and, consequently, for capsules.

- Economic conditions, such as rising incomes and urbanization, are driving the shift of consumers’ preferences towards health and well-being products.

- In countries such as Brazil, the authorities are more and more favourable to the use of dietary supplements, which encourages the local industry to invest in the production of capsules.

Did You Know?

“Approximately 70% of all capsules produced worldwide are made of gelatin. But the demand for vegetable capsules is rapidly increasing and according to some estimates the growth rate in this segment is about 20%.” — Market Research Future

Segmental Market Size

The capsule market is a vital part of the pharmaceutical and dietary industries, which is currently experiencing a steady growth. This segment is important for drug delivery systems, especially for orally administered products, as it offers a convenient and reliable way to encapsulate the active ingredients. The growing number of chronic diseases, which necessitates new formulations, and the growing consumer demand for dietary supplements, especially those in capsule form, are two of the main factors driving the capsule market. In addition, the regulatory framework favoring the use of gelatin and vegetarian capsules is a significant driver of the market.

In the meantime, the capsule has reached a state of general acceptance, and the companies Capsugel (which belongs to Lonza) and Qualicaps are the market leaders. In the pharmaceutical industry, the capsule is used in the preparation of medicines, both prescription and over-the-counter, and in the food supplement industry, especially in the manufacture of vitamins and herbal supplements. The growing interest in the concept of sustainability has led to the development of plant-based capsules, and the production processes for capsules are continually being improved to increase efficiency and flexibility. The capsule industry is therefore in a good position to adapt to changing consumer and regulatory needs.

Future Outlook

The capsules are filled with empty capsules. The capsules are filled with empty capsules. The growth in the demand for pharmaceuticals is based on the growing demand for pharmaceutical preparations, especially in the areas of dietary supplements and individual medicine. The need for effective drug delivery systems will continue to drive the empty capsules market in both developed and emerging markets.

And a recent technological development, the introduction of capsules made of gelatine and from vegetable sources, is expected to spur market growth. The development is in line with the growing demand for vegetarian and vegetarian products. The regulatory support for the use of capsules in various therapeutic applications will also support the growth of the capsules market. Also, the growing importance of e-pharmacy and the growing focus on sustainable packaging solutions will play an important role in the future of the capsules market, making it a dynamic and evolving sector.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 1.61 Billion |

| Growth Rate | 6.81% (2024-2032) |

Empty Capsule Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.