Growth of the Healthcare Sector

The expansion of the healthcare sector is significantly contributing to the Emergency Medical Supplies Market. As healthcare systems evolve and expand, the demand for emergency medical supplies is expected to rise correspondingly. Hospitals, clinics, and emergency response teams are increasingly investing in high-quality medical supplies to ensure they are equipped to handle emergencies efficiently. Market analysis indicates that the healthcare sector's growth is projected to continue, driven by factors such as an aging population and increased healthcare spending. This growth presents a substantial opportunity for suppliers of emergency medical supplies, as healthcare providers seek reliable and effective solutions to enhance their emergency response capabilities.

Advancements in Medical Technology

Technological innovations are significantly influencing the Emergency Medical Supplies Market. The integration of advanced technologies, such as telemedicine, portable diagnostic devices, and automated external defibrillators, enhances the efficiency and effectiveness of emergency medical responses. These advancements not only improve patient outcomes but also streamline the logistics of supply distribution. For instance, the introduction of smart medical kits equipped with real-time monitoring capabilities is transforming how emergency supplies are utilized. As technology continues to evolve, the market is likely to witness an influx of innovative products, further driving the demand for emergency medical supplies.

Government Initiatives and Funding

Government initiatives aimed at enhancing emergency preparedness are playing a pivotal role in the Emergency Medical Supplies Market. Various governments are allocating funds to improve emergency response systems, which includes the procurement of medical supplies. These initiatives often focus on equipping first responders and healthcare facilities with the necessary tools to handle emergencies effectively. Recent reports indicate that government spending on emergency medical supplies has increased, reflecting a commitment to public safety. This trend is likely to continue as governments recognize the importance of being prepared for unforeseen events, thereby driving growth in the emergency medical supplies sector.

Increasing Incidence of Emergencies

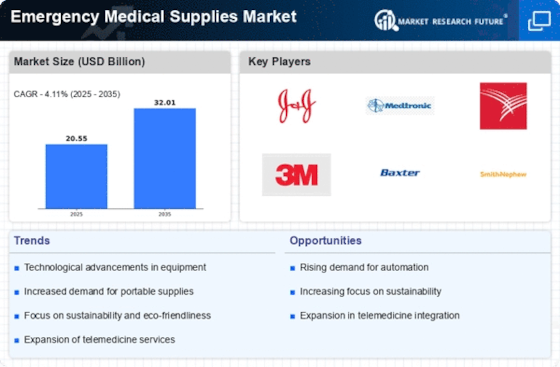

The Emergency Medical Supplies Market is experiencing growth due to the rising incidence of emergencies, including natural disasters, accidents, and health crises. As populations expand and urban areas become more densely populated, the likelihood of emergencies increases. This trend necessitates a robust supply of emergency medical supplies to ensure timely and effective responses. According to recent data, the demand for emergency medical supplies has surged, with projections indicating a compound annual growth rate of approximately 6.5% over the next five years. This growth is driven by the need for preparedness and rapid response capabilities, highlighting the critical role of emergency medical supplies in mitigating the impact of emergencies.

Rising Awareness of Health and Safety

There is a growing awareness of health and safety among populations, which is positively impacting the Emergency Medical Supplies Market. Educational campaigns and community initiatives are fostering a culture of preparedness, encouraging individuals and organizations to invest in emergency medical supplies. This heightened awareness is reflected in increased sales of first aid kits, personal protective equipment, and other essential supplies. Market data suggests that this trend is likely to continue, with a projected increase in consumer spending on emergency preparedness products. As communities prioritize safety, the demand for emergency medical supplies is expected to rise, creating opportunities for manufacturers and suppliers.