Electrophysiology Size

Electrophysiology Market Growth Projections and Opportunities

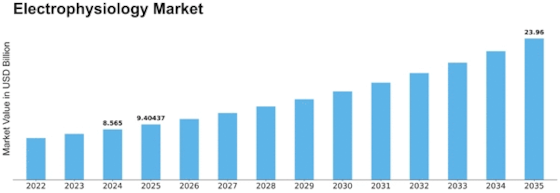

The global electrophysiology market valued USD 7.1 billion in 2022 and is expected to swell at a CAGR of 9.80% over the forecast period. It is predicted that the market will reach valuation of USD 16.1 billion until 2032 from valuation of USD 7.8 billion in 2023. The increased demand for cardiac rhythm control devices throughout the world is the reason for this growth. In order to address the complex electrical circuits of the heart, the market offers a range of diagnostic and treatment instruments, including as catheters, mapping systems, and ablation technologies. Developments in electrophysiological technology are crucial in determining the nature of the industry. Better catheter designs, more sophisticated mapping and ablation technologies, and superior imaging modalities are the results of ongoing innovation. The electrophysiology market is expanding because to these advancements, which also enhance the precision and accuracy of diagnostic techniques and provide more affordable, minimally invasive treatment choices. One important element impacting market dynamics is the regulatory environment around electrophysiological treatments and medical devices. Strict legal requirements guarantee the security, effectiveness, and calibre of electrophysiological technologies, which affects their acceptance, licencing, and use. In order to enter the market and foster confidence among patients, regulatory agencies, and healthcare providers, compliance with regulatory regulations is crucial. The adoption of electrophysiological procedures is influenced by regional differences in healthcare infrastructure and economic conditions. Electrophysiology interventions are widely used, and the demand for associated technology is influenced by variations in healthcare access, reimbursement regulations, and economic situations. Companies in the market need to manoeuvre through these varied environments to guarantee that their electrophysiological solutions meet the distinct demands presented by various healthcare systems. In the electrophysiology market, constant innovation and distinctiveness define the competitive environment. Businesses carry out R&D to launch new products with better features, such greater energy delivery for ablation, 3D mapping capabilities, and real-time navigation. This climate of competition encourages a cycle of innovation, pushing industry participants to remain at the forefront of technical developments and add to the growing scope of electrophysiological treatments. Events pertaining to global health, like the COVID-19 pandemic, have an impact on the electrophysiology market. The demand for some electrophysiological treatments was impacted by the pandemic's interruption of elective medical operations. However, the industry recovered and expanded because healthcare systems were flexible and acknowledged the importance of electrophysiological operations. Market innovation is facilitated by alliances and collaborations amongst research organizations, healthcare facilities, and suppliers of electrophysiological technology. These partnerships take advantage of group knowledge to tackle particular problems in cardiac electrophysiology, such customized therapy plans and the creation of cutting-edge mapping tools. The collaboration of many stakeholders quickens the speed of electrophysiological technology development and provides solutions that meet the changing demands of the healthcare sector. Consideration of the patient-centric approach to healthcare is important in the market for electrophysiology. Technologies that put an emphasis on shorter recovery periods, procedural efficiency, and patient safety become more popular. The creation of electrophysiological solutions that improve patient outcomes, reduce radiation exposure, and improve overall patient experience is consistent with the patient-centered paradigm of contemporary healthcare. Initiatives pertaining to education and training are crucial components of the electrophysiology industry. With the intricacy of electrophysiology treatments, healthcare personnel are being trained to employ modern technology with increasing importance. Workshops, simulation tools, and educational programmes all help to build skills and guarantee the best possible use of electrophysiological technology.

Leave a Comment