Electronic Weighing Scale Size

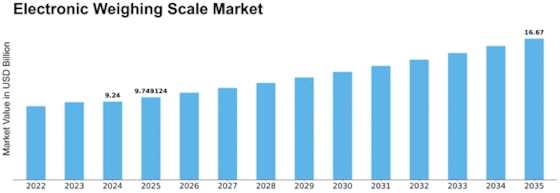

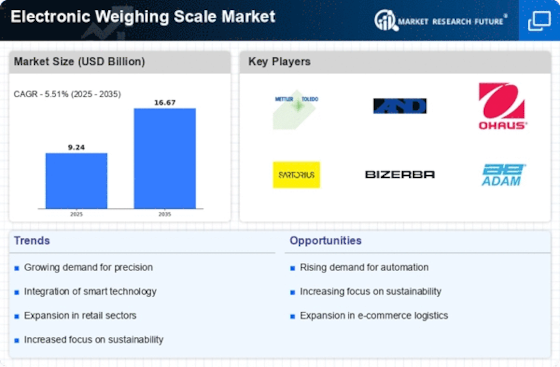

Electronic Weighing Scale Market Growth Projections and Opportunities

The Electronic Weighing Scale Market is shaped by many factors in the market. Together, these forces determine how it works. One main reason for this market is the growing need in many businesses to accurately and quickly measure weight. Companies in areas like health care, food and drink, shipping goods or services, and selling things need careful weight details to run their businesses. This need is pushing the increase in demand for electronic weighing scales. Companies want to use these advanced tools to improve their operations and decision making processes. Technology improvements are very important in changing the market for electronic scales. The changes in sensor tech, screens and ways to connect have made fancy electronic scales with better features. These improvements make electronic weighing scales more precise and helpful. They also help them work better overall. Makers want to stay ahead in technology change for many different needs of industries and people. Another important thing affecting the market for electronic weighing scales is following rules. Governments and groups that set rules for businesses make strong laws so weighing tools work well, can be trusted, and are safe. These rules are very important for makers to get trust in the market and meet laws of different jobs. Sticking to rules for electronic weighing machines not only makes them good quality, but also increases trust in people who use them. This helps the market get bigger too. Competition in the market is a big part that changes how businesses work in electronic scales industry. The business has big, long-lasting companies and newcomers using creativity. Strong competition makes companies keep doing research and creating new products. This helps to bring better items into the market all the time. Big firms work on growing their range of things they sell. Newcomers try to change the market with fresh ideas, making a lively and competitive world for everyone.

Leave a Comment