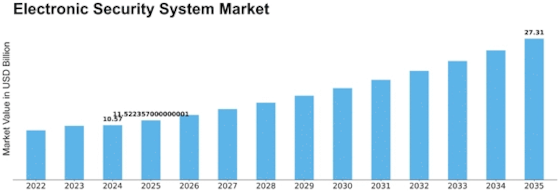

Electronic Security System Size

Electronic Security System Market Growth Projections and Opportunities

The Electronic Security System market is influenced by a myriad of factors that collectively shape its dynamics. One crucial market factor is the rising awareness and concern about security across various sectors. With an increasing number of security threats and incidents, both individuals and organizations are recognizing the need for robust electronic security systems to safeguard their assets and premises. This heightened awareness is driving the demand for advanced security solutions, propelling the growth of the electronic security system market.

Another significant market factor is technological advancements. The continuous evolution of technology has led to the development of more sophisticated and efficient electronic security systems. Innovations such as artificial intelligence, biometrics, and advanced video analytics have enhanced the capabilities of security systems, making them more effective in detecting and preventing security breaches. As a result, businesses and residential users are inclined to invest in state-of-the-art electronic security solutions, contributing to the expansion of the market.

Government regulations and compliance standards also play a pivotal role in shaping the electronic security system market. Governments worldwide are implementing stringent regulations to ensure the security and privacy of individuals and organizations. Compliance with these regulations is driving the adoption of electronic security systems that meet the specified standards. Companies operating in the market must align their products with these regulations to remain competitive and gain the trust of their customers.

The economic landscape and overall financial health of a region or country significantly impact the electronic security system market. During periods of economic growth, businesses and consumers tend to invest more in security measures. Conversely, economic downturns may lead to budget constraints, affecting the willingness of potential buyers to invest in expensive electronic security solutions. Understanding and adapting to these economic cycles are crucial for companies operating in the market to navigate challenges and identify growth opportunities.

Globalization is another market factor influencing the electronic security system industry. As businesses expand their operations globally, the need for standardized and scalable security solutions becomes paramount. Multinational corporations seek integrated electronic security systems that can be deployed across various locations seamlessly. This trend has led to increased collaboration between security system providers and global enterprises to deliver comprehensive and consistent security solutions worldwide.

Competitive dynamics also shape the electronic security system market. The presence of numerous players competing for market share has intensified innovation and product development. Companies strive to differentiate themselves by offering unique features, better performance, and cost-effectiveness. This competition fosters a dynamic market environment, encouraging continuous improvements in electronic security systems.

Lastly, the increasing connectivity and integration of electronic security systems with other technologies contribute to market growth. The emergence of the Internet of Things (IoT) and smart technologies has enabled the creation of interconnected security ecosystems. Electronic security systems that can seamlessly integrate with other smart devices, networks, and platforms are highly sought after. This interconnectedness enhances overall security effectiveness and provides users with more comprehensive control and monitoring capabilities.

Leave a Comment