Market Trends

Key Emerging Trends in the Electrical Component for Desalination Plant Market

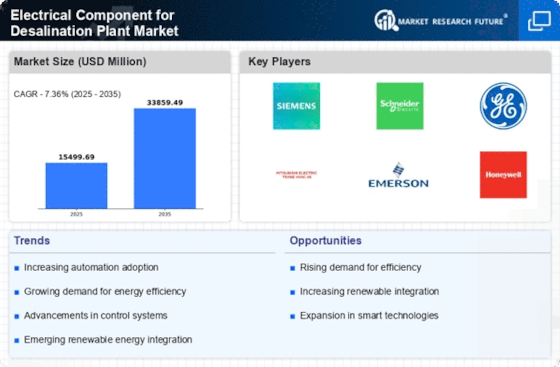

The market for electrical components in desalination plants is witnessing significant trends driven by the growing demand for fresh water and advancements in desalination technology. One notable trend is the increasing adoption of automation and digitalization in desalination processes. As desalination plants strive for greater efficiency, reliability, and operational flexibility, there is a growing reliance on advanced electrical components such as sensors, actuators, controllers, and SCADA systems to monitor and control various aspects of the desalination process. Automation enables real-time monitoring, predictive maintenance, and optimization of plant operations, resulting in improved energy efficiency, reduced downtime, and lower operating costs.

Moreover, there is a growing emphasis on energy efficiency and sustainability in desalination plants, driving demand for energy-efficient electrical components and renewable energy integration. With energy consumption being a significant operational cost for desalination plants, there is a growing focus on optimizing energy usage through the use of energy recovery devices, high-efficiency motors, variable frequency drives, and renewable energy sources such as solar and wind power. Electrical components that enable energy recovery from brine streams and optimize power consumption play a crucial role in reducing the environmental footprint and operational costs of desalination plants.

Furthermore, the increasing complexity and scale of desalination projects are driving demand for advanced electrical components capable of handling higher capacities and operating under harsh environmental conditions. Mega-scale desalination plants with capacities exceeding millions of gallons per day require robust electrical infrastructure, including transformers, switchgear, cables, and distribution panels, to ensure reliable and uninterrupted power supply. Additionally, the proliferation of seawater desalination projects in remote and arid regions necessitates the use of electrical components that can withstand extreme temperatures, corrosive environments, and variable grid conditions.

In addition to technological advancements, regulatory requirements and water quality standards are shaping market trends in the electrical component sector for desalination plants. Stringent regulations governing water quality, discharge standards, and environmental protection drive the adoption of advanced electrical components for water treatment, disinfection, and monitoring. Electrical instrumentation and control systems that ensure compliance with regulatory requirements, such as online monitoring of water quality parameters and automatic control of chemical dosing, are essential for maintaining water quality and public health standards.

Moreover, the COVID-19 pandemic has underscored the importance of resilient and reliable water infrastructure, leading to increased investments in desalination projects worldwide. The pandemic has highlighted the vulnerability of freshwater sources to disruptions and underscored the need for diversified water supplies, driving demand for desalination plants as a reliable source of fresh water. This has led to a surge in investments in desalination projects, driving demand for electrical components and systems to support the expansion and modernization of desalination infrastructure.

Leave a Comment