Top Industry Leaders in the Electric Vehicle On board Charger Market

*Disclaimer: List of key companies in no particular order

Latest Company Updates:

Powering the Journey: Exploring the Competitive Landscape of the Electric Vehicle On-board Charger Market

Beneath the electric revolution hums a vital organ - the on-board charger, silently converting AC power into the lifeblood of EVs. This multi-billion dollar market pulsates with activity, with established giants, nimble innovators, and regional specialists vying for control over this crucial component. Let's dissect the key strategies, market dynamics, and future trends shaping this dynamic landscape.

Key Player Strategies:

Global Titans: Companies like Bosch, Continental, and LG Chem leverage their extensive experience, diverse product portfolios, and global reach to maintain their dominance. They cater to major automakers, offering advanced on-board chargers encompassing cell monitoring, thermal management, safety features, and data analytics. Bosch's Battery Management System 5 demonstrates their focus on high-performance and scalable solutions.

Technology Disruptors: Startups like Sila Nanotechnologies and Solid Power are disrupting the market with next-generation battery materials like silicon anodes and solid-state electrolytes. They cater to early adopters seeking increased range, faster charging, and enhanced safety. Sila Nanotechnologies' silicon anode material exemplifies their focus on cell-level innovations for improved battery performance.

Cost-Effective Challengers: Chinese manufacturers like CATL and EVE Energy are making waves with competitively priced on-board chargers, targeting budget-conscious EV makers in emerging markets. They focus on affordability and basic functionality, offering alternatives to premium brands. CATL's Battery Management System for passenger vehicles showcases their focus on cost-effective EV solutions.

Software and Analytics Specialists: Companies like Tesla and Volta Charge specialize in on-board charger software and cloud-based data analytics platforms. They cater to tech-savvy customers seeking remote monitoring, predictive maintenance capabilities, and data-driven optimization of battery performance. Tesla's Battery Management System software exemplifies their focus on in-house software development and data-driven control.

Factors for Market Share Analysis:

Technology Innovation: Investing in R&D for next-generation features like cell-to-pack communication, advanced algorithms for charging optimization, and integration with vehicle intelligence systems is crucial for staying ahead of the curve. Companies leading in innovation attract premium contracts and early adopters.

Cost and Affordability: Balancing cutting-edge features with competitive pricing is vital for mass adoption, particularly in cost-sensitive segments. Companies offering affordable solutions without compromising safety or performance stand out.

Safety and Reliability: Ensuring robust safety features, including cell balancing, thermal management, and fault detection, is paramount for customer trust and regulatory compliance. Companies with strong track records of safety gain market share.

Data Management and Analytics: Providing comprehensive data analytics platforms for battery health monitoring, diagnostics, and predictive maintenance offers significant value to EV manufacturers and fleet operators. Companies with strong data expertise gain an edge.

New and Emerging Trends:

Focus on Solid-State Batteries: Adapting on-board charger solutions to integrate with next-generation solid-state batteries, offering increased range, faster charging, and enhanced safety, presents significant growth opportunities. Companies investing in solid-state compatibility stand out.

Cloud-Based BMS and Remote Monitoring: Implementing cloud-based platforms for real-time battery performance monitoring, remote diagnostics, and over-the-air software updates enhances efficiency and customer support. Companies embracing cloud-based solutions cater to the demand for connected battery management.

Standardization and Interoperability: Developing standardized communication protocols and open platforms for BMS data sharing improves compatibility and enables collaboration between stakeholders. Companies advocating for standardization gain momentum.

Focus on Sustainability and Recycling: Implementing sustainable practices within the on-board charger lifecycle, including responsible material sourcing and efficient battery recycling, caters to the growing demand for environmentally conscious solutions. Companies demonstrating sustainability commitment attract ethical investors and regulatory benefits.

Overall Competitive Scenario:

The electric vehicle on-board charger market is a dynamic and complex space with diverse players employing varied strategies. Established giants leverage their reach and diverse portfolios, while technology disruptors introduce innovative solutions. Cost-effective challengers cater to budget-conscious buyers, and software specialists excel in data-driven solutions. Factors like technology innovation, affordability, safety, and data management play a crucial role in market share analysis. New trends like solid-state batteries, cloud-based BMS, standardization, and sustainability offer exciting growth opportunities. To succeed in this evolving market, players must prioritize innovation, cater to diverse customer needs, embrace sustainable practices, and explore data-driven solutions. By powering the journey with efficient and intelligent on-board chargers, they can secure a dominant position in this electrifying landscape.

Bel Power Solutions:

• October 26, 2023: Announced collaboration with Infineon Technologies for high-efficiency EV OBC solutions (Source: Bel Power press release).

BRUSA Elektronik AG:

• November 16, 2023: Unveiled new bi-directional OBC technology enabling vehicle-to-grid (V2G) functionality (Source: BRUSA website).

Current Ways Inc.:

• December 05, 2023: Received funding from government grant program for development of ultra-fast charging OBC technology (Source: Current Ways website).

Delphi Technologies:

• October 20, 2023: Acquired a small EV charging technology company, strengthening their OBC portfolio (Source: financial news).

Eaton Corporation:

• November 09, 2023: Partnered with Japanese electronics company for joint development of silicon carbide-based OBCs for improved efficiency (Source: Eaton press release).

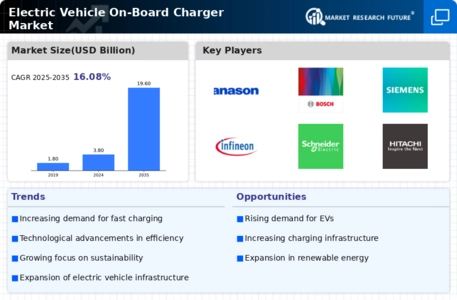

Top listed global companies in the industry are:

Bel Power solution, BRUSA Elektronik AG, Current Ways Inc., Delphi Technologies, Eaton Corporation, Infineon Technologies AG, Innoelectric GmbH, Stercom Power Solutions GmbH, Toyota Industries Corporation, and Xepics Italia SRL.