Top Industry Leaders in the Electric Vehicle Connector Market

*Disclaimer: List of key companies in no particular order

Electric Vehicle Connector Market Latest Company Updates:

The Electric Vehicle Connector Market: A Charged Competitive Landscape

The electric vehicle (EV) revolution is sparking a parallel boom in the market for the crucial link between vehicle and charger - the EV connector. This seemingly simple component presents a surprisingly dynamic competitive landscape, driven by factors like evolving standards, charging speeds, and strategic approaches by key players. Let's delve into the complexities of this market, analyzing the strategies, trends, and overall scenario shaping its future.

Key Players and Their Strategies:

Established Giants: Leading automotive giants like Tesla, Volkswagen, and Nissan are leveraging their existing ecosystems to develop proprietary connector technologies. This provides them control over charging infrastructure and customer loyalty, but risks fragmenting the market.

Tier 1 Suppliers: Established players like TE Connectivity, Yazaki, and Amphenol are capitalizing on their expertise in automotive electronics and connectors to offer standardized solutions. They prioritize compatibility and scalability, aiming to become go-to suppliers for diverse charging infrastructure providers.

Emerging Innovators: Start-ups like Charin and Lectron are driving innovation with charging connectors offering wireless capabilities, faster speeds, and enhanced security features. They target niche markets or specific charging use cases with differentiated solutions.

Factors Influencing Market Share Analysis:

Technology Standard Adoption: Regional and global standardization efforts influence connector adoption. The CCS and CHAdeMO standards dominate fast-charging in Europe and Asia, respectively, while Tesla's Supercharger network uses a proprietary connector. Compatibility with existing infrastructure plays a crucial role in determining market share.

Charging Speed and Infrastructure Development: As the demand for faster charging increases, connector manufacturers race to develop solutions capable of handling higher power. Companies that can partner with charging infrastructure providers and offer efficient, high-speed connectors stand to gain a significant advantage.

Cost and Price Sensitivity: Price remains a critical factor for both manufacturers and charging station operators. Finding the balance between innovative features and affordability will be key to capturing market share, especially in price-sensitive regions.

New and Emerging Trends:

Wireless Charging: Eliminate the need for physical plugs altogether with wireless charging solutions. Companies like WiTricity and Plugless Power are leading the charge, aiming for convenience and improved safety.

Vehicle-to-Grid (V2G) Technology: Bidirectional charging allows EVs to not only draw power but also feed it back to the grid, creating a more dynamic and resilient energy system. Connector manufacturers that integrate V2G capabilities will hold an edge in this evolving landscape.

Cybersecurity Integration: As charging infrastructure becomes more complex, cybersecurity threats grow. Companies offering connectors with built-in security features and data encryption can cater to the increasing demand for secure charging solutions.

Overall Competitive Scenario:

The EV connector market is witnessing a dynamic interplay between established players, innovative start-ups, and evolving technologies. Standardization efforts, race for faster charging solutions, and cost considerations will continue to shape market dynamics. Companies that adapt to these trends, forge strategic partnerships, and develop differentiated offerings stand to carve a leading position in this rapidly evolving and lucrative space.

Yazaki: In October 2023, Yazaki announced a partnership with Tesla to supply charging components for the Supercharger network in Europe. They are also developing high-voltage DC connectors for fast-charging applications. (Source: Yazaki newsroom)

Schneider Electric: Schneider Electric acquired French charging infrastructure company Sicon in November 2023 to expand its EV charging solutions portfolio. They are also investing in wireless charging technology for commercial fleets. (Source: Schneider Electric press release)

Tesla: In September 2023, Tesla opened its Supercharger network to select non-Tesla vehicles in North America. This move could further solidify their connector's position as a potential global standard. (Source: Tesla blog post)

Bosch: Bosch is collaborating with Volkswagen Group to develop a standardized high-voltage connector for use in their electric vehicles. They are also exploring wireless charging solutions for public charging infrastructure. (Source: Bosch website)

ABB: In August 2023, ABB launched a new line of ultra-fast chargers capable of delivering up to 900 kW. They are also a major supplier of CCS connectors for the European market. (Source: ABB newsroom)

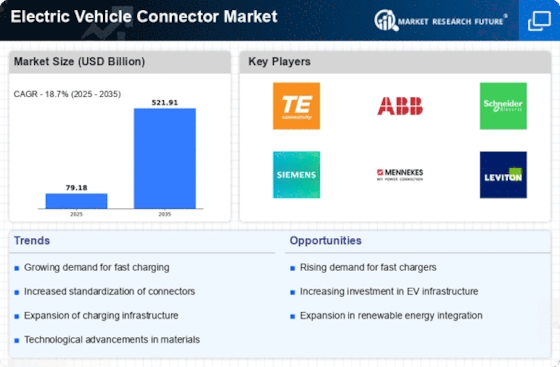

Top listed global companies in the industry are:

Yazaki (Japan)

Schneider Electric (France)

Tesla (U.S.)

Bosch (Germany)

ABB (China)

Siemens AG (Germany)

Fujikura (Japan)

Amphenol (U.S.)

Huber+Suhner (Switzerland)

Sumitomo (Japan)

Among others.