Growing Environmental Concerns

The rising awareness of environmental issues is a significant driver for the Electric Vehicle Battery Cathode Market. As climate change and air pollution become increasingly pressing concerns, consumers and governments alike are prioritizing sustainable transportation solutions. The shift towards electric vehicles is seen as a crucial step in reducing greenhouse gas emissions and improving air quality. This societal shift is prompting automakers to invest heavily in electric vehicle technology, including the development of efficient battery cathodes. The Electric Vehicle Battery Cathode Market is likely to benefit from this trend, as manufacturers seek to produce cathodes that not only enhance battery performance but also utilize sustainable materials, aligning with the growing demand for eco-friendly products.

Advancements in Battery Technology

Technological advancements in battery chemistry and design are significantly influencing the Electric Vehicle Battery Cathode Market. Innovations such as the development of nickel-rich cathodes and solid-state batteries are enhancing energy density and safety, which are critical for EV performance. Recent studies indicate that the energy density of lithium-ion batteries could increase by up to 30% with the adoption of new cathode materials. These advancements not only improve the range and efficiency of electric vehicles but also reduce costs, making EVs more accessible to a broader audience. As manufacturers continue to invest in research and development, the Electric Vehicle Battery Cathode Market is poised for substantial growth, driven by these technological breakthroughs.

Rising Demand for Electric Vehicles

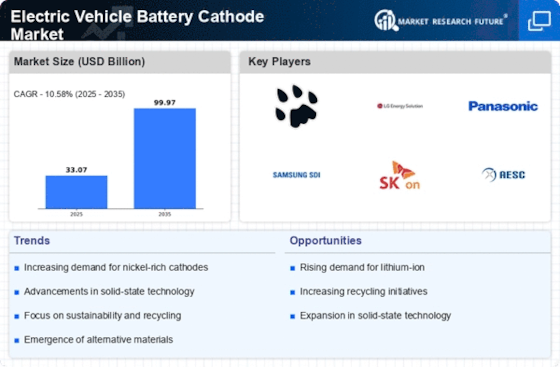

The increasing consumer preference for electric vehicles (EVs) is a primary driver for the Electric Vehicle Battery Cathode Market. As more individuals and businesses seek sustainable transportation options, the demand for EVs is projected to rise significantly. According to recent data, the EV market is expected to grow at a compound annual growth rate (CAGR) of over 20% through the next decade. This surge in demand directly influences the need for advanced battery technologies, particularly cathodes, which are crucial for enhancing battery performance and longevity. Consequently, manufacturers are focusing on developing high-capacity cathodes to meet the evolving requirements of the EV market, thereby propelling the Electric Vehicle Battery Cathode Market forward.

Government Incentives and Regulations

Government policies and incentives aimed at promoting electric vehicle adoption are pivotal in shaping the Electric Vehicle Battery Cathode Market. Various countries have implemented tax credits, rebates, and subsidies to encourage consumers to purchase EVs. Additionally, stringent emissions regulations are compelling automakers to transition from internal combustion engines to electric powertrains. For instance, several nations have set ambitious targets for phasing out gasoline and diesel vehicles, which is likely to drive the demand for EVs and, by extension, the cathodes used in their batteries. This regulatory environment fosters innovation and investment in the Electric Vehicle Battery Cathode Market, as companies strive to comply with new standards while enhancing battery efficiency.

Increased Investment in EV Infrastructure

The expansion of electric vehicle charging infrastructure is a vital driver for the Electric Vehicle Battery Cathode Market. As more charging stations are established, consumer confidence in electric vehicles is expected to rise, leading to increased adoption rates. Investment in charging infrastructure is projected to reach billions of dollars in the coming years, facilitating the growth of the EV market. This, in turn, creates a higher demand for electric vehicle batteries, including advanced cathodes that support faster charging and longer battery life. The Electric Vehicle Battery Cathode Market stands to gain from this trend, as the need for efficient and reliable battery solutions becomes paramount in supporting the expanding EV ecosystem.