Market Trends

Key Emerging Trends in the Electric Construction Vehicles Market

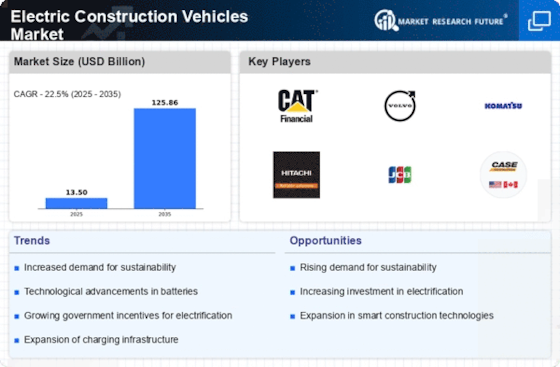

The global shift towards sustainable practices coupled with adoption of green technologies by the construction industry has led to sharp rise in demand for electric construction vehicles since 2015.The surge is driven by rapid industrialization which has equally brought its negative effects on environment. Among such trends is increased awareness and emphasis on environmental sustainability. Efforts by governments around the world together with other organizations to reduce carbon emissions and combat climate change have prompted this sector of economy seeking eco-friendly alternatives. With lesser noise levels coupled with lower carbon footprints, EVs become favorites of construction firms seeking to be more environment-conscious.

Another significant trend is the electromobility construction machinery market is integrating advanced technologies to improve efficiency and performance. Automation, telematics, and connectivity features have become ingrained in electric construction vehicles offering benefits such as real-time monitoring, predictive maintenance and increased operational control. While these state-of-the art technologies are part of improving overall functionality of these machines, they also make them safer and people working on site more productive.

The adoption of electrical machinery in the building process has been motivated by cost factors. However, although initially it may cost a fortune to own an electric vehicle compared with their traditional counterparts; but for building companies long-term operational cost savings provide a compelling reason for owning one. Besides that, there has been increasing availability of government incentives, subsidies as well as favorable financing options making electric construction vehicles economically viable over time. Notably, the economic case for using electrical machines in construction will strengthen as the costs come down due to advances in battery technology and increases in energy density.

The expanding charging infrastructure is also helping in the electrification of construction fleets. Governments and private stakeholders are investing in building a robust charging network to serve the growing number of electric vehicles, including those used in construction. Fast-charging stations and ground-breaking charging solutions available now have helped address one of the main concerns of EVs—“range anxiety”. This infrastructure development has been key to easing kickstarting construction companies into embracing electric fleets, given their ease and efficiency in recharging these vehicles.

The growth of the electric construction vehicles market is being boosted by partnerships and collaborations between major players in the automotive and construction sectors. To hasten the process of developing and delivering innovative solutions, established manufacturers are partnering with technology firms as well as start-ups that specialize in electric vehicle components. Not only does this collaborative approach facilitate knowledge transfer but it also takes advantage of various industry players who can scale up electric construction vehicles.

Leave a Comment