Aging Population

The aging population is a significant factor influencing the Global ACE Inhibitors Market Industry. As individuals age, the incidence of chronic conditions such as hypertension and heart failure increases, leading to a higher demand for effective treatment options. By 2024, the global population aged 60 and over is expected to reach approximately 1.4 billion, creating a substantial market for ACE inhibitors. This demographic shift suggests that healthcare systems will increasingly rely on ACE inhibitors as a cornerstone of treatment for age-related cardiovascular issues. Consequently, this trend is likely to enhance the market's growth trajectory over the coming years.

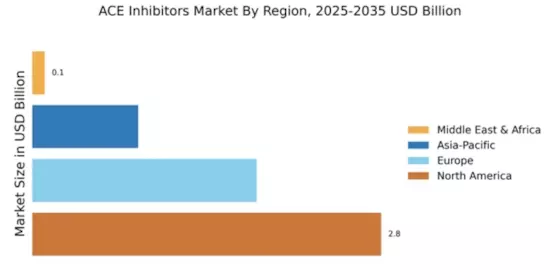

Market Growth Projections

The Global ACE Inhibitors Market Industry is projected to experience substantial growth over the next decade. With a market value of 5.55 USD Billion in 2024, it is anticipated to reach 8.02 USD Billion by 2035, reflecting a compound annual growth rate of 3.41% from 2025 to 2035. This growth trajectory is indicative of the increasing demand for ACE inhibitors driven by factors such as the rising prevalence of hypertension, advancements in pharmaceutical research, and an aging population. The market's expansion is likely to be supported by ongoing regulatory developments and heightened awareness of cardiovascular health.

Increased Awareness and Education

Increased awareness and education regarding cardiovascular health are pivotal drivers of the Global ACE Inhibitors Market Industry. Public health campaigns and educational initiatives have heightened understanding of hypertension and its associated risks. This growing awareness encourages individuals to seek medical advice and treatment, leading to an uptick in prescriptions for ACE inhibitors. Healthcare professionals are also more informed about the benefits of these medications, which further supports their use in clinical practice. As awareness continues to expand, the market is poised for growth, aligning with the projected increase in market value to 8.02 USD Billion by 2035.

Rising Prevalence of Hypertension

The increasing prevalence of hypertension globally is a primary driver of the Global ACE Inhibitors Market Industry. As of 2024, approximately 1.28 billion adults worldwide are estimated to have hypertension, a condition that ACE inhibitors are commonly prescribed to manage. This growing patient population is likely to propel the demand for ACE inhibitors, contributing to the market's projected value of 5.55 USD Billion in 2024. Furthermore, the World Health Organization emphasizes the need for effective hypertension management, which further underscores the relevance of ACE inhibitors in treatment protocols. As awareness of hypertension rises, the market is expected to expand significantly.

Regulatory Support for ACE Inhibitors

Regulatory bodies play a crucial role in shaping the Global ACE Inhibitors Market Industry. Supportive regulations and guidelines from organizations such as the U.S. Food and Drug Administration and the European Medicines Agency facilitate the approval and availability of ACE inhibitors. These regulatory frameworks ensure that new and existing medications meet safety and efficacy standards, thereby fostering confidence among healthcare providers and patients. As a result, the market is likely to benefit from a steady influx of approved ACE inhibitors, which could contribute to the projected compound annual growth rate of 3.41% from 2025 to 2035, further solidifying the market's position.

Advancements in Pharmaceutical Research

Innovations in pharmaceutical research are driving the Global ACE Inhibitors Market Industry forward. Ongoing research efforts focus on enhancing the efficacy and safety profiles of existing ACE inhibitors, as well as developing novel formulations. For instance, recent studies have explored combination therapies that incorporate ACE inhibitors with other antihypertensive agents, potentially improving patient outcomes. This trend not only fosters a competitive landscape but also encourages investment in the development of new drugs. As the market evolves, these advancements may contribute to the anticipated growth, with projections indicating a market value of 8.02 USD Billion by 2035.