Top Industry Leaders in the Elastomeric Coating Market

From weatherproofing skyscrapers to sealing roofs, the elastomeric coatings market, hides a dynamic battleground where giants clash and startups scramble for dominance. These flexible, protective barriers, stretching with the substrate like a second skin, are woven into diverse industries, yet the competition beneath the smooth surface is fierce. Let's peel back the layers and explore the factors shaping market share, industry news, and recent developments that paint a vibrant picture of this resilient ecosystem.

From weatherproofing skyscrapers to sealing roofs, the elastomeric coatings market, hides a dynamic battleground where giants clash and startups scramble for dominance. These flexible, protective barriers, stretching with the substrate like a second skin, are woven into diverse industries, yet the competition beneath the smooth surface is fierce. Let's peel back the layers and explore the factors shaping market share, industry news, and recent developments that paint a vibrant picture of this resilient ecosystem.

Key Players and Adopted Strategies:

-

BASF SE (Germany): This chemical giant leverages its global reach, extensive product portfolio, and brand recognition to secure a significant market share. Their focus on high-performance elastomeric coatings and technical expertise attracts premium customers in demanding sectors like infrastructure and marine applications. -

Dow Chemical Company (USA): Renowned for innovation, Dow capitalizes on its R&D prowess to develop novel elastomeric coatings with enhanced functionalities like improved fire retardancy and self-healing properties. Their emphasis on niche applications like protective coatings for offshore platforms drives market differentiation. -

PPG Industries, Inc. (USA): A leading paint and coatings manufacturer, PPG focuses on sustainability and eco-friendly solutions. Their emphasis on bio-based resins and low-VOC options resonates with environmentally conscious consumers and regulatory bodies. -

NIPPON PAINT HOLDINGS CO., LTD. (Japan): This Asian player utilizes its regional presence and cost-efficient production to control a sizable market share. Their readily available options and competitive pricing strengthen their position in price-sensitive sectors like residential construction. -

The Sherwin-Williams Company (USA): This diversified coatings giant leverages its strong distribution network and customer relationships to expand its reach. Their focus on customized solutions and technical support caters to diverse application needs across various industries.

Factors Shaping Market Share:

-

Infrastructure Development: Growing investments in infrastructure projects in emerging economies drive the demand for elastomeric coatings for corrosion protection and durability. -

Weatherproofing Needs: Increased focus on energy efficiency and building longevity fuels the demand for elastomeric coatings for roofs, walls, and facades. -

Sustainability Concerns: Consumer preference for eco-friendly and low-VOC solutions pushes manufacturers towards bio-based resins and renewable energy sources. -

Technological Advancements: Development of new application methods, self-healing technologies, and advanced resins expands the application range and performance of elastomeric coatings. -

Cost Optimization: Efficient production processes, minimizing raw material usage, and offering competitive pricing are crucial for profitability in a price-sensitive market.

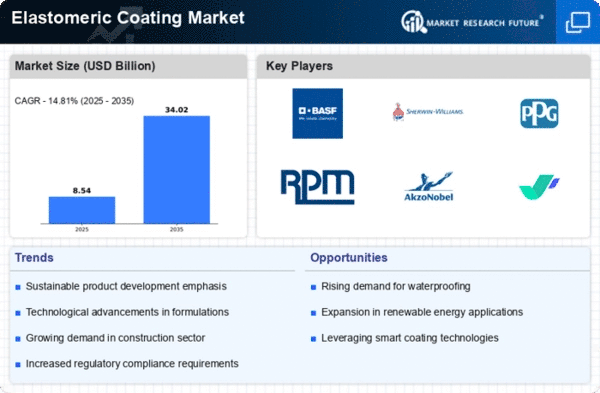

Key players

BASF SE (Germany)PPG Industries Inc. (US)Clariant (Switzerland)The Sherwin-Williams Company (US)Dulux Group (Australia)Nippon Paints (Japan)Jotun A/S (Norway)Progressive Painting Inc. (US)BEHR Process Corporation (US)and Rodda Paints (US).

Recent Developments:

-

October 2023: A startup unveils a portable spray system for applying elastomeric coatings to intricate surfaces, increasing accessibility and ease of application. -

November 2023: BASF integrates recycled plastic waste into its elastomeric coating formulations, minimizing environmental impact and reducing production costs. -

December 2023: Dow Chemical partners with regional construction companies to pilot self-cleaning elastomeric coatings for buildings, potentially reducing maintenance costs and improving aesthetics.