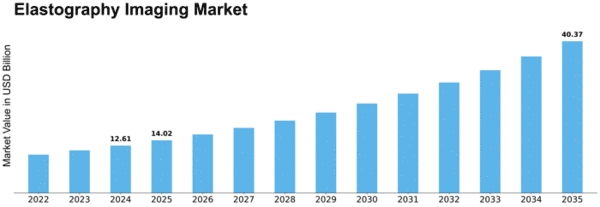

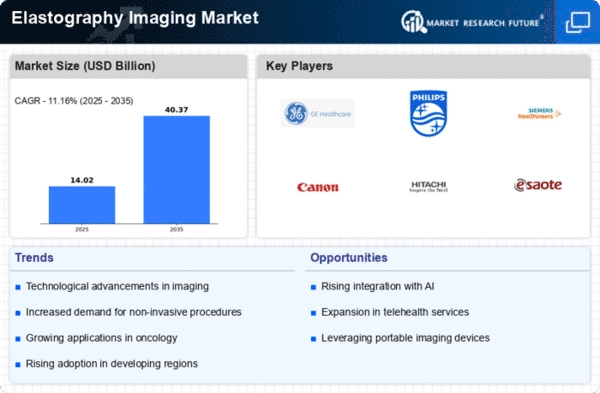

Elastography Imaging Size

Elastography Imaging Market Growth Projections and Opportunities

Market elements driving elastography imaging growth include increased liver disease rates worldwide. Elastography is a crucial non-invasive liver fibrosis test. It detects and monitors cirrhosis and hepatitis early. Elastography imaging has grown in popularity due to patient safety and non-invasive testing. Market growth is due to patients and physicians selecting non-invasive diagnostic procedures over regular ones. As elastography imaging technologies improve, diagnostic findings are increasingly accurate and dependable. New technologies like shear wave elastography and acoustic radiation force impulse imaging let clinicians identify tissue types more accurately, growing the market. Growing populations have led to chronic ailments like liver disorders that require frequent checkups. Elastography imaging addresses the health demands of this age group by quickly and painlessly diagnosing and treating age-related diseases. Elastography imaging was originally used to identify liver illness, but today it's employed elsewhere. Musculoskeletal disorders, breast lumps, and thyroid cancers are diagnosed using the method. This has expanded its market and led to more physicians adopting it in various medical specialties. The global healthcare expense increase has benefited the elastography imaging market. Healthcare institutions are investing more in innovative medical instruments to enhance patient outcomes. These expenditures boosted elasticity imaging. New medical techniques improve patient outcomes and cut chronic disease treatment costs, and governments worldwide are understanding this. The industry has risen due to regulations, financing, and initiatives that enable new testing technologies like elastography imaging simpler to use. Making healthcare staff and consumers aware of elastography imaging' advantages has driven industry expansion. Educational initiatives, seminars, and collaboration between healthcare institutions and technology companies have improved knowledge of the technology's advantages. Competition among the top elastography imaging providers is driving new technology and solutions. Strategic cooperation between corporations and research institutions are creating new applications and growing the market. Although the market is improving, elastography imaging therapies are not reimbursed properly. Payment rates vary per region, slowing market expansion. This highlights how vital standard reimbursement rules are for widespread elastography imaging.

Leave a Comment