Educational Toys Size

Educational Toys Market Growth Projections and Opportunities

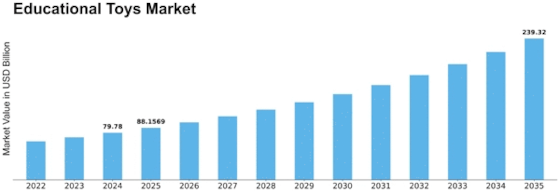

In 2022, the market for educational toys was estimated to be worth USD 65.3 billion. The distribution channel for the educational toys market is expected to expand at a compound annual growth rate (CAGR) of 10.50% between 2023 and 2032, from USD 72.2 billion in 2023 to USD 160.4 billion by 2032. The main factors driving the market growth are the growing number of parents focusing on helping their children develop their creative and problem-solving skills, as well as the expansion of government initiatives to support the local toy production sector.

The educational toys market, a significant segment within the toy industry, is shaped by various market factors that contribute to its trends and growth. One key factor is the increasing recognition among parents and educators of the importance of early childhood development through play. Educational toys are designed to engage children in activities that stimulate cognitive, social, and motor skills, aligning with the growing emphasis on early learning experiences. This market responds to the demand for toys that not only entertain but also contribute to a child's intellectual and emotional development.

Technological advancements and innovations in educational toys play a crucial role in market dynamics. The integration of digital technologies, augmented reality, and interactive features into educational toys enhances their appeal and effectiveness. Brands that invest in cutting-edge technologies, engaging content, and age-appropriate designs align with the preferences of parents and educators seeking educational toys that leverage the benefits of modern technology while fostering learning through play.

Consumer demographics, including age groups and educational philosophies, significantly impact the educational toys market. Parents with young children, particularly those in the preschool and early elementary age range, are a primary consumer demographic. The diverse preferences of parents, including a focus on STEM (science, technology, engineering, and mathematics) education or a desire for toys that promote creativity and critical thinking, prompt brands to offer a wide variety of educational toy options. Understanding the specific educational goals and philosophies of parents allows the industry to cater to a broad range of preferences.

Economic factors, such as disposable income and purchasing power, play a crucial role in the educational toys market. Economic stability in regions with higher disposable incomes may lead to increased spending on educational toys, particularly those with premium features or technology integration. Economic downturns, however, may influence consumer preferences towards more budget-friendly options as parents seek cost-effective yet impactful learning tools for their children.

Brand image and educational credibility are vital elements shaping consumer perceptions within the educational toys market. Well-established educational toy brands and those endorsed by educational experts often benefit from positive associations with quality, safety, and learning efficacy. Effective marketing campaigns that highlight the educational benefits, safety standards, and developmental milestones achieved through play contribute to a brand's visibility and appeal, influencing consumer preferences and trust.

Market accessibility and distribution channels significantly impact the availability of educational toys to consumers. Widespread distribution through various retail channels, including toy stores, department stores, educational supply stores, and online platforms, ensures that parents and educators have easy access to a diverse range of educational toys. The growth of e-commerce has further increased accessibility, allowing consumers to explore and purchase educational toys conveniently.

Sustainability considerations are gaining prominence in the educational toys market as environmental awareness grows. Parents and educators seek toys made from eco-friendly materials, following ethical manufacturing practices and promoting sustainability. Brands that adopt environmentally conscious approaches, such as using recycled materials, biodegradable packaging, and eco-friendly manufacturing processes, resonate with consumers seeking educational toys that align with their values of environmental responsibility.

Competition within the educational toys market fosters innovation and drives brands to differentiate themselves. Numerous brands, ranging from established educational toy manufacturers to emerging players, compete to offer toys with unique educational features, engaging content, and diverse learning outcomes. This competitive landscape prompts manufacturers to continuously enhance their product portfolios, introducing new technologies, themes, and educational approaches to meet the evolving preferences of parents and educators.

Regulatory considerations, including safety standards and educational guidelines, are crucial in the educational toys market. Governments and regulatory bodies enforce guidelines to ensure that educational toys meet specific safety criteria, including age-appropriate design and non-toxic materials. Adherence to these regulations is essential for manufacturers to build trust among consumers and comply with legal requirements in different markets.

Leave a Comment