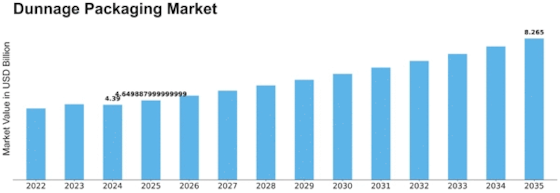

Dunnage Packaging Size

Dunnage Packaging Market Growth Projections and Opportunities

The dunnage packaging market is influenced by various market factors that shape its dynamics and growth trajectory. One significant factor is the increasing demand for efficient and cost-effective packaging solutions in industries such as automotive, electronics, aerospace, and manufacturing. Dunnage packaging, also known as void fill or cushioning materials, plays a crucial role in protecting goods during transportation and storage by filling empty spaces, securing fragile items, and preventing damage from shocks and vibrations. With the rise of global trade and e-commerce, there is a growing need for reliable and versatile dunnage packaging solutions that can withstand the rigors of the supply chain while minimizing product damage and losses. This trend is driven by factors such as increasing consumer expectations for product quality, brand reputation, and customer satisfaction, driving the expansion of the dunnage packaging market.

Moreover, technological advancements and innovations play a crucial role in shaping market dynamics within the dunnage packaging industry. Manufacturers are investing in research and development to improve the design, performance, and sustainability of dunnage packaging materials. Advanced materials such as air pillows, foam inserts, molded pulp, and recyclable plastics enable the production of dunnage packaging solutions with superior cushioning properties, durability, and environmental sustainability. Additionally, innovations in packaging design and automation technologies enable the efficient production and deployment of dunnage packaging solutions that meet specific customer requirements and application needs. These technological advancements drive product innovation, enabling manufacturers to offer a diverse range of dunnage packaging solutions tailored to different industries, products, and transportation modes.

Furthermore, regulatory requirements and quality standards influence market factors in the dunnage packaging industry. The transportation and handling of goods are subject to regulations and standards governing packaging, labeling, and handling practices to ensure safety, compliance, and environmental protection. Dunnage packaging materials must meet regulatory requirements such as ISTA (International Safe Transit Association) testing, ASTM (American Society for Testing and Materials) specifications, and ISO (International Organization for Standardization) certifications to be suitable for use with specific types of products and transportation modes. Additionally, manufacturers of dunnage packaging must adhere to industry standards such as REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) directives to ensure product quality, safety, and environmental responsibility. These regulatory requirements create barriers to entry for new players and reinforce the importance of established manufacturers with a track record of compliance and quality assurance. Further, the heat regulation and eco-friendly nature of the package make its use prevalent. The industries using this package are automotive, construction, food and beverage market. Further, the penetration of eCommerce sites is another important factor driving demand. The use of this package in retail and commercial industries is increasing the overall supply rate.

Moreover, market factors such as raw material prices, supply chain disruptions, and economic conditions influence the pricing and availability of dunnage packaging materials. Fluctuations in the prices of raw materials such as paper, plastic, and foam directly impact the cost of dunnage packaging production. Supply chain disruptions, such as natural disasters, geopolitical tensions, and transportation bottlenecks, can lead to shortages of raw materials and delays in production, affecting the availability of dunnage packaging materials in the market. Additionally, economic factors such as GDP growth, consumer spending, and industrial activity influence demand for packaging materials and, consequently, the dunnage packaging market. During periods of economic expansion, there is typically increased demand for packaged goods and industrial products, driving the growth of the dunnage packaging market.

Furthermore, changing industry trends and customer preferences influence market dynamics within the dunnage packaging industry. Customers are increasingly seeking packaging solutions that offer sustainability, efficiency, and ease of use. Dunnage packaging materials that are recyclable, biodegradable, and made from renewable resources are preferred by environmentally conscious consumers and businesses seeking to minimize their environmental impact. Additionally, industry trends such as omni-channel retailing, lean manufacturing, and supply chain optimization drive the adoption of dunnage packaging solutions that are versatile, adaptable, and compatible with automated packaging systems. As industries evolve and adapt to changing market dynamics, the demand for dunnage packaging continues to grow, creating opportunities for manufacturers to innovate and expand their product offerings to meet evolving customer needs.

Leave a Comment