Top Industry Leaders in the Ductless HVAC system Market

*Disclaimer: List of key companies in no particular order

Latest Company Updates:

Cooling Without Condensation: Exploring the Competitive Landscape of Ductless HVAC Systems

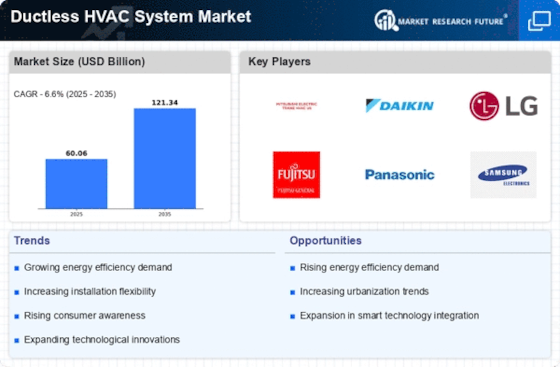

In the sweltering summers and chilly winters, a discreet hero emerges – the ductless HVAC system market. This multi-billion dollar landscape hums with activity, with established giants, nimble pioneers, and regional champions vying for a share in the comfortable climate control of homes and businesses, all without the cumbersome constraints of ductwork. Let's delve into the key strategies, market dynamics, and future trends shaping this dynamic space.

Key Player Strategies:

Global Titans: Companies like Mitsubishi Electric, Daikin Industries, and LG Electronics leverage their extensive experience, diverse product portfolios, and global reach to maintain their dominance. They cater to a broad customer base, offering ductless systems with various capacities, functionalities, and energy efficiency ratings. Mitsubishi Electric's Mr. Slim series exemplifies their focus on high-performance and reliable solutions.

Technology Disruptors: Startups like Senville and EcoSmart Home are disrupting the market with next-generation features like variable refrigerant flow (VRF) technology, advanced inverter compressors, and smart home integration. They cater to tech-savvy customers seeking superior efficiency, personalized comfort, and seamless connectivity. Senville's Ethos series showcases their focus on innovative technology and user-friendly controls.

Cost-Effective Challengers: Chinese manufacturers like Midea and Gree Electric Appliances are making waves with competitively priced ductless systems, targeting budget-conscious buyers in emerging markets. They focus on affordability and basic functionality, offering alternatives to premium brands. Midea's U-Match series demonstrates their focus on cost-competitive solutions.

Regional Champions: Companies like Fujitsu General in Japan and Haier Thermocool in India excel in specific geographic regions, leveraging strong local relationships and deep understanding of regional regulations and climate needs. They offer tailored ductless systems and service networks optimized for their markets. Fujitsu General's FJ series exemplifies their focus on regional adaptation and energy efficiency in tropical climates.

Factors for Market Share Analysis:

Energy Efficiency and Cooling Capacity: Offering ductless systems with high SEER (Seasonal Energy Efficiency Ratio) ratings and superior cooling capabilities, catering to diverse climate zones and building sizes, is crucial for market share expansion. Companies with efficient and powerful systems gain an edge.

Functionality and Smart Features: Providing ductless systems with multi-zone control, Wi-Fi connectivity, voice control integration, and advanced filtration capabilities caters to the demand for personalized comfort and convenience. Companies with feature-rich and smart systems stand out.

Cost and Affordability: Balancing advanced features with competitive pricing is vital for mass adoption, particularly in cost-sensitive markets. Companies offering affordable ductless solutions without compromising quality and performance gain an edge.

Installation and Service Network: Establishing a comprehensive network of skilled installers and readily available spare parts for quick service builds customer trust and market share. Companies with strong post-sales support gain an edge.

New and Emerging Trends:

Focus on Hyper-Efficiency and Inverter Technology: Utilizing next-generation inverter compressors and refrigerant control systems allows for significantly improved energy efficiency, reduced operating costs, and quieter operation. Companies leading in hyper-efficiency technologies attract environmentally conscious customers and regulatory benefits.

Integration with Renewable Energy Sources: Pairing ductless systems with solar panels or geothermal energy sources offers eco-friendly solutions and caters to the growing demand for sustainable cooling and heating. Companies embracing renewable energy integration stand out in this evolving landscape.

Focus on Indoor Air Quality and Filtration: Offering ductless systems with advanced air filtration technology, including allergens and virus removal capabilities, addresses growing concerns about indoor air quality and health. Companies prioritizing high-performance filtration gain an edge.

Personalization and User-Centric Design: Developing customizable ductless systems with modular units, flexible installation options, and user-friendly controls caters to the demand for personalized comfort and design flexibility. Companies prioritizing user-centric design stand out in this competitive space.

Overall Competitive Scenario:

The ductless HVAC system market is a dynamic and complex space with diverse players employing varied strategies. Established giants leverage their reach and diverse portfolios, while technology disruptors introduce innovative solutions. Cost-effective challengers cater to budget-conscious buyers, and regional champions excel in specific markets. Factors like energy efficiency, functionality, affordability, and service networks play a crucial role in market share analysis. New trends like hyper-efficiency, renewable energy integration, advanced filtration, and user-centric design offer exciting growth opportunities. To succeed in this evolving market, players must prioritize innovation, cater to diverse customer needs, embrace sustainable practices, and explore technology-driven solutions. By offering discreet yet powerful climate control without the complexities of ductwork, they can secure a dominant position in this booming landscape.

Samsung Electronics Co. Ltd.

• August 2023: Launched new WindFree™ AI WindWall air conditioner with improved airflow and smart features. (Source: Samsung Newsroom, August 8, 2023)

Hitachi Ltd.

• October 2023: Introduced new multi-zone system with R32 refrigerant, offering higher efficiency and reduced environmental impact. (Source: Hitachi Global, October 26, 2023)

United Technologies Corporation (Carrier)

• July 2023: Acquired Automated Building Controls company, expanding its smart home integration capabilities for ductless systems. (Source: GlobeNewswire, July 12, 2023)

LG Electronics

• November 2023: Unveiled new DUAL Inverter technology for ductless systems, promising significant energy savings. (Source: LG Global, November 7, 2023)

Johnson Controls (York)

• October 2023: Released a white paper on the benefits of using CO2 refrigerant in ductless systems for further environmental sustainability. (Source: Johnson Controls, October 19, 2023)

Top listed global companies in the industry are:

Samsung Electronics Co. Ltd.

Hitachi Ltd.

United Technologies Corporation

LG Electronics

Johnson Controls

Mitsubishi Electric Corporation

Whirlpool Corporation

Daikin Industries Ltd.

Electrolux

Trane