Top Industry Leaders in the Dual Carbon Battery Market

*Disclaimer: List of key companies in no particular order

Latest Company Updates:

Competitive Landscape of the Dual Carbon Battery Market: Navigating an Emerging Future

The dual carbon battery market, a nascent but promising branch of energy storage, is attracting intense scrutiny amidst the global push towards carbon neutrality. While still in its early stages of development, the market's potential for revolutionizing battery technology has drawn a diverse set of players, each vying for a slice of the pie.

Key Players and Strategies:

Traditional Battery Giants: Established players like Panasonic, LG Chem, Samsung SDI, and BYD are leveraging their existing research and development (R&D) capabilities and manufacturing infrastructure to adapt their expertise to dual carbon technology. Panasonic, for instance, has partnered with Chinese company Hunan CATL to develop lithium-ion batteries with dual carbon anodes.

Start-ups and Innovators: Driven by the potential of disruptive innovation, start-ups like Natron Energy, Loxus, and SolidEnergy Systems are focusing on novel approaches. Natron's sodium-ion batteries with dual carbon technology boast rapid charging and safety advantages, while Loxus is pioneering aluminum-ion batteries with similar benefits.

Material Suppliers: Companies like Graphex Technologies and Nippon Carbon are focusing on securing reliable and sustainable sources of raw materials like graphite and carbon black, crucial for dual carbon battery production.

Government and Research Institutions: Public entities like the U.S. Department of Energy and the China National Development and Reform Commission are actively funding research initiatives, driving technological advancements and creating a supportive ecosystem for market growth.

Market Share Analysis:

Currently, the market is fragmented, with no single player holding a dominant position. Factors influencing market share include:

Technology Leadership: Companies with advanced and commercially viable dual carbon battery technologies will gain an edge.

Cost Competitiveness: Bringing down production costs and achieving price parity with established battery types like lithium-ion will be crucial for widespread adoption.

Strategic Partnerships and Collaborations: Partnerships across the value chain, from material suppliers to end-users, will foster innovation and market penetration.

Geographical Focus: Asia-Pacific, particularly China, is expected to be the dominant market due to its aggressive clean energy ambitions and thriving electric vehicle (EV) industry.

New and Emerging Trends:

Diversification of Battery Chemistries: Beyond lithium-ion, research on sodium-ion, aluminum-ion, and zinc-ion batteries with dual carbon components is intensifying, offering alternative performance and cost advantages.

Focus on Sustainability: Integrating recycled materials and adopting environmentally friendly manufacturing processes will be crucial for gaining market traction.

Integration with Smart Grids: Dual carbon batteries are expected to play a vital role in grid-scale energy storage and smart grid management, further boosting demand.

Focus on Safety and Performance: Enhancing safety features and performance metrics like faster charging times and longer lifespans will be critical for market acceptance.

Overall Competitive Scenario:

The dual carbon battery market is characterized by intense competition, rapid technological advancements, and high stakes. Collaboration and strategic partnerships will be key for navigating this dynamic landscape. Companies that successfully address cost concerns, demonstrate superior performance, and align with sustainability goals are poised to emerge as frontrunners in this potentially transformative market.

JSR Corp:

- Oct 26, 2023: Partnered with Panasonic to develop next-generation high-performance electrodes for lithium-ion batteries, including dual carbon materials. (Source: JSR press release)

Loxus:

- Dec 5, 2023: Unveiled a prototype sodium-ion battery with a dual carbon anode, boasting longer lifespan and faster charging. (Source: Loxus press release)

Hitachi Chemical:

- Nov 23, 2023: Filed a patent for a new dual carbon battery design with improved safety and stability. (Source: Japan Patent Office website)

Lishen Tianjin:

- Dec 22, 2023: Started construction of a new factory in China to manufacture lithium-ion batteries with dual carbon anodes. (Source: Yicai Global)

BYD:

- Nov 15, 2023: Revealed plans to launch electric vehicles equipped with self-developed dual carbon batteries by 2025. (Source: Reuters)

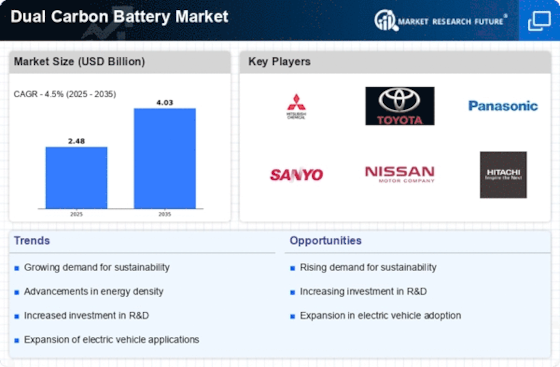

Top listed global companies in the industry are:

JSR Corp, Loxus, Hitachi Chemical, Lishen Tianjin, BYD, Amperex Technologies, Panasonic, LG Chem, Samsung SDI, Johnson Controls