Dry Sandpaper Size

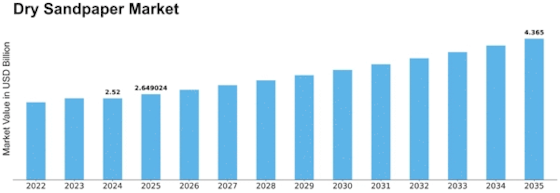

Dry Sandpaper Market Growth Projections and Opportunities

The dry sandpaper market is influenced by several key factors that shape its production, demand, and pricing dynamics. One significant driver of this market is the widespread use of dry sandpaper across various industries and applications. Dry sandpaper, also known as abrasive paper, is used for sanding and smoothing surfaces in woodworking, metalworking, automotive refinishing, construction, and DIY projects. It comes in various grit sizes and abrasive materials such as aluminum oxide, silicon carbide, and garnet, catering to different surface finishing requirements. The increasing demand for precision and quality surface finishing in manufacturing and construction activities drives the adoption of dry sandpaper, thereby fueling market growth.

Another significant factor influencing the dry sandpaper market is technological advancements and innovations in abrasive manufacturing processes. Manufacturers are continually innovating to improve abrasive particle bonding, coating techniques, and backing materials to enhance product performance and durability. Advanced manufacturing technologies such as electrostatic coating, precision slitting, and automated packaging enable the production of dry sandpaper with consistent grit size distribution, uniform abrasive coverage, and enhanced tear resistance. Additionally, advancements in abrasive formulations and surface treatments lead to the development of specialized sandpapers for specific applications such as metal grinding, wood sanding, and automotive bodywork. These technological advancements not only improve user productivity and efficiency but also drive down production costs, thereby stimulating market growth.

Furthermore, market demand for dry sandpaper is closely tied to the performance and growth of end-user industries. In the woodworking sector, dry sandpaper is used for surface preparation, finishing, and polishing of wooden furniture, cabinets, flooring, and decorative items. The increasing demand for high-quality woodworking products, coupled with the growing trend towards DIY woodworking projects, drives the adoption of dry sandpaper in the woodworking industry. Similarly, in the automotive sector, dry sandpaper finds applications in paint preparation, surface leveling, and polishing of vehicle bodies and components. The automotive aftermarket segment, driven by vehicle maintenance, repair, and refinishing activities, contributes to the growth of the dry sandpaper market in the automotive industry.

Market competition is another significant factor influencing the dry sandpaper market dynamics. The presence of numerous manufacturers and suppliers competing for market share can lead to price competition and product differentiation strategies. Factors such as product quality, grit performance, durability, and availability in various sizes and configurations play crucial roles in gaining a competitive edge within the market. Strategic alliances, partnerships, and mergers & acquisitions are common strategies adopted by market players to strengthen their market position, expand their product portfolios, and enhance their geographic reach.

Furthermore, regulatory standards and industry certifications play a crucial role in shaping the dry sandpaper market. Regulatory requirements related to product safety, performance, and environmental impact drive the adoption of quality standards such as OSHA, ANSI, and EN in the manufacturing and use of dry sandpaper products. Compliance with these standards ensures product reliability, durability, and suitability for various applications, thereby fostering customer trust and confidence in dry sandpaper products. Additionally, adherence to regulatory standards enables manufacturers to access global markets and compete effectively on a global scale.

Moreover, global economic conditions and trade policies impact the dry sandpaper market on a broader scale. Economic factors such as GDP growth, construction activities, industrial production, and consumer spending influence the demand for dry sandpaper products across different regions. Trade policies, tariffs, and geopolitical tensions can disrupt supply chains and trade flows, thereby affecting market dynamics and prices. Additionally, currency exchange rates and inflation rates can impact the competitiveness of dry sandpaper manufacturers operating in global markets.

Leave a Comment