Regulatory Support and Market Access

Regulatory bodies are increasingly recognizing the potential of drug-coated balloon technologies, which is fostering a conducive environment for the Drug-Coated Balloon Catheter Market. Streamlined approval processes and favorable reimbursement policies are encouraging manufacturers to invest in research and development. For example, recent initiatives aimed at expediting the review of innovative medical devices are likely to enhance market access for new entrants. This regulatory support not only facilitates the introduction of advanced products but also instills confidence among healthcare providers regarding the safety and efficacy of these devices. Consequently, this trend is expected to bolster market growth in the foreseeable future.

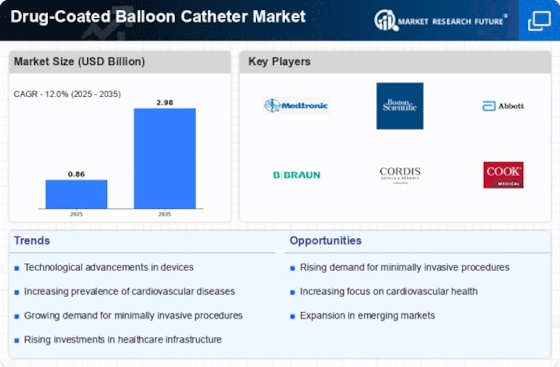

Increasing Prevalence of Vascular Diseases

The rising incidence of vascular diseases, including coronary artery disease and peripheral artery disease, is a critical driver for the Drug-Coated Balloon Catheter Market. As populations age and lifestyle-related health issues become more prevalent, the demand for effective treatment options is escalating. Reports suggest that cardiovascular diseases account for a substantial portion of global mortality, prompting healthcare providers to seek innovative solutions. Drug-coated balloons offer a minimally invasive alternative to traditional stenting, appealing to both patients and clinicians. This trend is likely to result in a significant uptick in the adoption of drug-coated balloon technologies, further propelling market expansion.

Rising Demand for Minimally Invasive Procedures

The growing preference for minimally invasive procedures is significantly influencing the Drug-Coated Balloon Catheter Market. Patients and healthcare providers alike are increasingly favoring techniques that reduce recovery time and minimize surgical risks. Drug-coated balloons align with this trend by offering effective treatment options that can be performed with less trauma compared to traditional surgical methods. As awareness of the benefits of minimally invasive interventions continues to rise, the demand for drug-coated balloon catheters is likely to increase. Market analysts project that this shift in patient and provider preferences will contribute to a robust growth trajectory for the industry.

Expanding Applications in Interventional Cardiology

The Drug-Coated Balloon Catheter Market is witnessing an expansion in applications within interventional cardiology, which is driving market growth. These devices are increasingly being utilized not only for treating coronary artery disease but also for addressing other vascular conditions. The versatility of drug-coated balloons in various clinical scenarios, such as in-stent restenosis and small vessel disease, is enhancing their appeal among cardiologists. As clinical evidence supporting their efficacy accumulates, the adoption of these technologies is expected to rise. This trend indicates a promising future for the drug-coated balloon catheter market, with potential applications extending into new therapeutic areas.

Technological Advancements in Drug-Coated Balloon Catheters

The Drug-Coated Balloon Catheter Market is experiencing a surge in technological advancements that enhance the efficacy and safety of these devices. Innovations such as improved drug formulations and advanced balloon materials are being developed to optimize drug delivery and minimize complications. For instance, the introduction of biodegradable polymers is likely to improve patient outcomes by reducing the risk of restenosis. Furthermore, the integration of imaging technologies with drug-coated balloons may facilitate better procedural guidance, thereby increasing the success rates of interventions. As a result, these advancements are expected to drive market growth, with projections indicating a compound annual growth rate of over 10% in the coming years.