Drone Package Delivery System Size

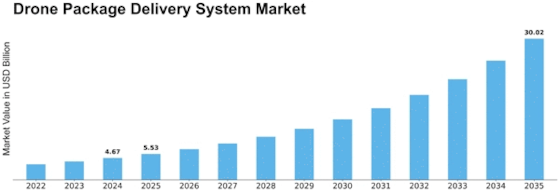

Drone Package Delivery System Market Growth Projections and Opportunities

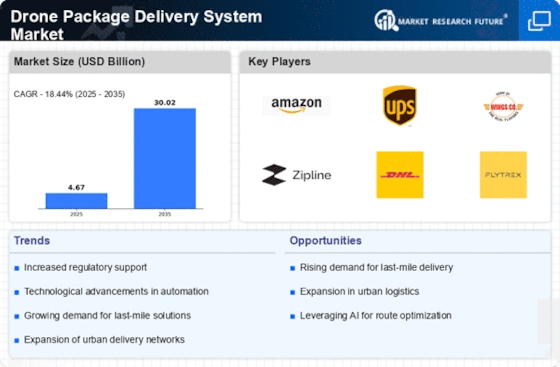

The drone package delivery system market is heavily influenced by several key factors driving its growth and evolution. One primary factor is the increasing demand for efficient and cost-effective last-mile delivery solutions. Traditional delivery methods face challenges such as traffic congestion, delivery delays, and high operational costs, particularly in urban areas. Drone package delivery systems offer a promising solution to these challenges by providing fast and direct delivery services, bypassing ground obstacles and reducing delivery times significantly. As e-commerce continues to grow and consumers increasingly expect faster delivery options, there is a corresponding increase in demand for drone package delivery systems to meet these evolving customer expectations.

Moreover, technological advancements play a crucial role in shaping the drone package delivery system market. Advances in drone technology, including improvements in battery life, payload capacity, navigation systems, and sense-and-avoid technology, have made it possible to develop drones capable of carrying larger payloads over longer distances. This enables drone operators to offer a wider range of delivery services, including delivering packages to remote locations, rural areas, and difficult-to-reach destinations. Additionally, advancements in automation, robotics, and artificial intelligence (AI) enable drones to perform tasks such as package sorting, loading, and unloading autonomously, reducing the need for human intervention and improving operational efficiency.

Furthermore, regulatory frameworks and government policies significantly influence market dynamics in the drone package delivery system market. Aviation authorities and regulatory agencies are responsible for developing regulations and guidelines that govern the operation of drones for commercial purposes, including package delivery. These regulations address various aspects of drone operations, including airspace management, flight safety, privacy, and security. Compliance with regulatory requirements is essential for drone operators to obtain the necessary permits, licenses, and approvals to conduct package delivery operations legally and safely. Additionally, government policies and initiatives aimed at promoting the adoption of drone technology, such as investment incentives, research grants, and pilot programs, can accelerate market growth and innovation in the drone package delivery system market.

Moreover, market demand for drone package delivery systems is driven by factors such as increasing online shopping trends, rising delivery volumes, and the need for contactless delivery options. The growth of e-commerce and online shopping has led to a surge in package delivery volumes, placing strain on traditional delivery networks and logistics infrastructure. Drone package delivery systems offer a scalable and efficient solution to handle the growing demand for last-mile delivery services, particularly in densely populated urban areas where traditional delivery methods face challenges such as traffic congestion and parking limitations. Additionally, the COVID-19 pandemic has accelerated the adoption of contactless delivery options, driving demand for drone package delivery systems that offer safe and hygienic delivery solutions without the need for face-to-face interaction.

Furthermore, market factors such as industry partnerships, technological collaborations, and investment trends drive innovation and growth in the drone package delivery system market. Drone operators, technology providers, logistics companies, and e-commerce retailers are forming strategic partnerships and collaborations to leverage complementary capabilities, expertise, and resources to develop and deploy drone package delivery systems. These partnerships enable companies to overcome technical challenges, address regulatory requirements, and accelerate the commercialization of drone delivery services. Additionally, investment trends in the drone industry, including venture capital funding, corporate investments, and government grants, provide financial support and validation for drone package delivery system initiatives, driving market growth and innovation.

Moreover, the impact of emerging technologies, such as urban air mobility (UAM), advanced air traffic management systems, and blockchain technology, is reshaping the drone package delivery system market. Urban air mobility (UAM) concepts envision a future where drones, air taxis, and other aerial vehicles operate in urban airspace to provide on-demand transportation and delivery services. Advanced air traffic management systems, such as Unmanned Traffic Management (UTM) systems, enable safe and efficient integration of drones into urban airspace, managing traffic flow, airspace access, and collision avoidance. Additionally, blockchain technology offers secure and transparent transactional platforms for managing drone operations, tracking deliveries, and ensuring data integrity and privacy in drone package delivery systems.

Leave a Comment