Market Share

Downstream Processing Market Share Analysis

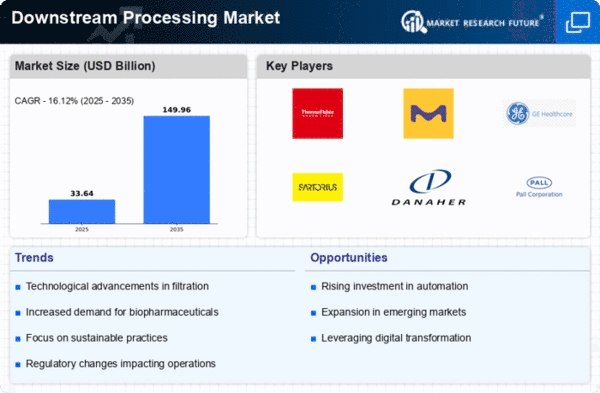

The downstream processing market assumes a significant part in the biopharmaceutical business, including the cleansing and recuperation of biotherapeutic items. Organizations in this area utilize different systems to lay out and reinforce their market share, given the basic job of downstream processing in guaranteeing the quality and proficiency of biopharmaceutical creation. Offering an exhaustive scope of downstream processing items is pivotal for market share situating. Organizations aim to give a set-up of arrangements including chromatography systems, filtration gadgets, and purging latices. A distinguished item portfolio permits them to take care of the different requirements of biopharmaceutical makers. The reception of single-use innovations is a remarkable market situating technique. Organizations stress the benefits of disposable systems, for example, diminished cross-containment risk and expanded adaptability underway. Satisfying the business need for additional sustainable and smart arrangements upgrades their market claim. Observing the one-of-a-kind qualities of various biopharmaceutical items, offering tweaked downstream processing arrangements is an essential methodology. Tailoring refinement techniques and advances to explicit biotherapeutics guarantees ideal yield and virtue, tending to the differed prerequisites of biopharmaceutical producers. Growing market presence worldwide is fundamental for organizations in the downstream processing area. Grasping territorial guidelines, adjusting items to different medical care systems, and laying out areas of strength for an organization add to effective worldwide development. Taking care of the necessities of biopharmaceutical makers overall improves market share. Creating practical estimating models is basic in a cutthroat market. Organizations decisively value their downstream processing items to offer worth without compromising quality. Adaptable estimating structures, for example, versatile authorizing models or packaged arrangements, take care of the assorted monetary contemplations of biopharmaceutical producers.

Leave a Comment