Emergence of Hybrid Events

The rise of hybrid events, which combine in-person and virtual experiences, is reshaping The Global DJ Equipment Industry. As event organizers seek to cater to diverse audiences, the demand for versatile DJ equipment that can accommodate both formats is increasing. This trend necessitates the development of equipment that supports high-quality streaming and remote participation, prompting manufacturers to innovate. The hybrid event model is expected to remain prevalent, suggesting a sustained demand for specialized DJ equipment that meets the needs of both live and virtual audiences. This evolution in event planning may lead to new opportunities for growth within the market.

Technological Advancements

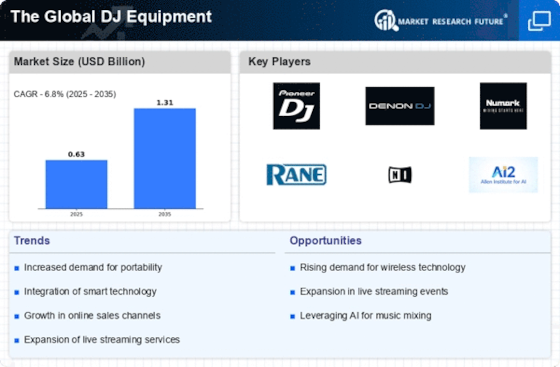

The rapid evolution of technology plays a pivotal role in shaping The Global DJ Equipment Industry. Innovations such as digital mixers, advanced software, and high-quality sound systems enhance the overall DJ experience. The integration of artificial intelligence and machine learning into DJ software allows for more intuitive mixing and track selection, appealing to both amateur and professional DJs. Furthermore, the increasing popularity of streaming services has led to a surge in demand for equipment that can seamlessly integrate with these platforms. As a result, the market is projected to grow at a compound annual growth rate of approximately 5.5% over the next five years, driven by these technological advancements.

Growing Live Event Industry

The resurgence of live events and music festivals significantly impacts The Global DJ Equipment Industry. As audiences return to in-person experiences, the demand for high-quality DJ equipment has surged. Major festivals and events require state-of-the-art sound systems and lighting setups, prompting DJs to invest in advanced equipment to meet audience expectations. According to industry reports, the live music sector is expected to reach a valuation of over 30 billion dollars by 2026, indicating a robust market for DJ equipment. This growth is likely to encourage manufacturers to innovate and expand their product offerings, further stimulating market dynamics.

Expansion of E-commerce Platforms

The growth of e-commerce platforms has transformed the way consumers purchase DJ equipment, significantly impacting The Global DJ Equipment Industry. Online retailers provide a vast selection of products, often at competitive prices, making it easier for DJs to access the latest technology. The convenience of online shopping, coupled with detailed product reviews and comparisons, enhances consumer confidence in purchasing decisions. As e-commerce continues to expand, it is anticipated that more consumers will opt for online purchases, leading to an increase in overall market sales. This shift in buying behavior is likely to drive innovation and competition among manufacturers.

Increased Popularity of DJ Culture

The rising popularity of DJ culture among younger demographics contributes to the expansion of The Global DJ Equipment Industry. With the advent of social media platforms, aspiring DJs can showcase their skills and reach wider audiences, leading to a surge in interest in DJing as a profession or hobby. This cultural shift has resulted in increased sales of entry-level equipment, such as controllers and mixers, as more individuals seek to participate in the DJ community. Market analysts suggest that this trend could lead to a sustained increase in demand for DJ equipment, as new generations continue to embrace and promote DJ culture.